I may have absolutely no clue what I am talking about or in rare moments of lucidity I might just exude a bit of common sense.

Hopefully this will encourage people to take an long hard look at those offering financial services which promise amazing results.

I am sure the main topics of discussion here would have no problem with people asking probing questions about the investment ideas they are being presented with. After all, it is your money and they no doubt only have your best interests at heart.

The late breaking news about the 50 billion Ponzi scheme perpetrated by Mr. Madehoff serves as a stark reminder that it doesn't matter how much you have, you can be preternaturally stupid when it comes to investing your own money..

As the late great Ronald Reagan said, "Trust but Verify"

On With the Show

Traveling through Florida for several years and usually on a Sunday, I had more than one opportunity to listen to the Sunday financial shows. On one of these shows, there was a Texan with a co-host who was pitching products guaranteed to make very large sums of money with no risk, but he couldn't tell you what the product was - you would have to call and come in.

I have forgotten the shark's name, but I do remember one of the local newspapers doing an in depth profile of the guy, some of his victims and the carcasses that were their portfolios which were left behind.

Apparently he was skirting that gray area which the law couldn't quite touch. There were pictures of his fine Texas home, his wife, his cars. I know I saved some of that information for posterity but alas, it was lost in one of the computer shuffles.

This guy appeared on a number Christian radio stations. Christians are some of the most gullible for this kind of thing, especially when the sponsor (host) is a Christian radio station.

Last weekend I was out in the garage, intending on listening to one of the programs I like and guess what rudely interrupted my planned listening period.

I heard a familiar patter about wonderful rates of return, no risk, no involvement in the stock market in a very familiar Texas twang.

Could that old shark from the past have come back for a Sunday revival meeting?

Well, I am not sure because I have forgotten the guy's name but it does pique my interest, and I am a little put out by not being able to listen to my regularly scheduled program.

What can I do with my irritation? How about providing what could be a valuable lesson as to how to perform basic research on these individuals swimming the waters out for your hard earned dollars.

Yes, It's Your Money - "I've got a passion for what I do. Yessir, I've got a passion for what I do."

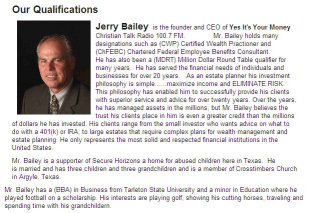

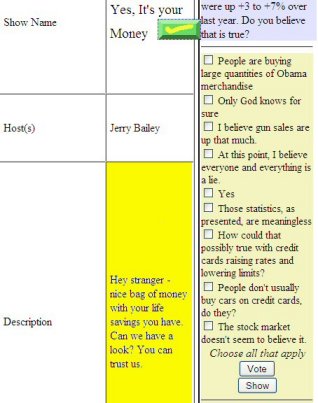

Yes, It's your money is a new financial radio show - at least is it is to me where the host, one Jerry Bailey and his faithful sidekick

Kevin Harris show you how to protect your money with their products and generate amazing returns at the same time.

Jerry is Batman and Kevin is Robin.

Who is this the host of 'Yes, It's Your Money? The Internet is a wonderful thing. Let's have a look:

Grandchildern? The spell checker needs some work.

These credentials they may or may not seem impressive depending on your financial knowledge.

If it looks impressive, you seriously need to pay attention.

Lets see, we have a CWP, ChFEBC and a MDRT. What to these impressive looking acronyms mean?

Why not take a trip over to FINRA.Org as a starting point to see what in the world a CWP is.

FINRA is a great place for getting a handle on acronyms.

Why doesn't this surprise me. There is no CWP but there is a CWPP, a Certified Wealth Preservation Planner. Sounds fairly important.

If I had a legitimate certification and it was not on a list like this, I would be for ensuring it gets included.

Anyway, a CWPP is close. Sounds impressive and must require lots of schooling................

Gee, I could be one of these too! No prerequisites or experience, a 24 hour course and a final exam on line.

One would have to work realllllly hard to obtain one of these.

What about being a ChFEBC?

This one at least is in the list.

Two day course, 3 years in employee benefits, On line, timed closed book exam.

Why is this not giving me a warm and fuzzy feeling?

And what is a MDRT? Milliionairres and Money? Sounds Really Important.

MDRT is not listed at all in FINRA. Let's Google it:

I am starting to look at this with a somewhat jaundiced eye.

You can't get too far in this site without joining and I doubt I possess the intellectual capacity and the dollars to join such a distinguished organization. Doing a bit more browsing, I found the MDRT Power Center! Sounds important!

Boy, this guy looks like he is cavorting among the rich but what is that he said - he is a qualifier? What does that mean? Almost made it? If I didn't know any better, I would say this site is centered around how to be a successful pitchman. Pitchmen of course, only have your best interest at heart, don't they?

I am less than impressed with the show host's credentials. His bio also says he has been around for over 20 years so if I was him, I certainly be working on fleshing out the bio.

Let's go visit Texas:

It appears the ChFEBC designation is accurate and he has been a member since 2007. Since 2007?

There is a lot of information here and since the topic is 'Yes, It's Your Money', I think we should look a bit more..

Let's have a look at the address:

There is at least an address, but I can find no information about "Bailey Financial" and their residence at this address.

Maybe they moved. This looks like a high rent district.

Maybe I should Google "Bailey Financial". I did and this I found... and if you think I'm kidding, here is the link.

So what do you think so far? Should you be setting up an appointment? At least take an accountant or disinterested knowledgeable second party with you.

Or, how about sending half to me, no strings attached instead.

Listen to a lot of radio like I do and you will notice a number hastily set up operations looking to take advantage of scared seniors in these uncertain economic times. Be very careful.

As an aside there was an article out recently and I forget the source, but an in depth study study done on those hawking annuity products and who their targets were. For some reason it turned out the targets were largely one particular demographic - women in their 60's

Looking at the phone numbers, the primary number is in Dallas, Texas. 972-383-1515 appears to be a valid number.

What about the Cell Phone Number?

There is another address and related searchs come up with mortgage loans.

I also see a JBD, Inc. in Dallas and apparently there is more than one establishment at the address in Flower Mound, TX.

Let's have a look at the address first:

This is horse country and Jerry says he does raise horses so this is probably a business being run from a home.

Not exactly the center of a high rolling business district like I was kind of led to believe........

Anything else of interest?

What is Bradley Duall & Co?

Looks legitimate to me. I'll have a look around and see if anything in here looks interesting.

Two women run the business so perhaps one of them is related to the host of the show..

Rochelle runs the business so lets do a search on her and Jerry.

Well they do have one thing in common - they are both being sued.

Interesting - does "Employee Benefits" sound familiar? A recent suit too.

Anyway, continuing down the list:

A Yahoo address? Why not use domain based email address - would clearly appear more professional.

I wonder if you call the 1-800 number for "Yes, It's Your Money", where your call is routed to.

No CRD #: - I am guessing this is a registration with FINRA, which there isn't.

CFP Registration ID# is not listed, which is probably a number for a licensed financial planner.

Allianz - Insurance and Investment, Annuities and the like.

F&G - Looks like health insurance

Goldan - No clue what this is. Maybe Golden Insurance? I'd be for ensuring my affiliates names are at least spelled correctly.

I don't see anything here so far that would inspire me to invest anything other than the time to do this research with this guy.

He seems to be affiliated primarily with insurance companies and possibly has something to do with mortgages.

Yes, It's Your Money - The Show Itself

People do prey on the religious.....................

Notice another new address?

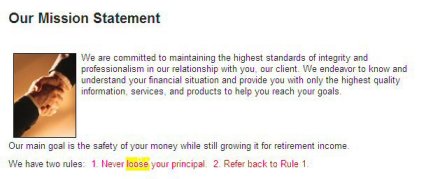

Gee, a Mission Statement. You would think the missionaries would at least double check their spelling.

The Show Itself

The show typically starts out with the host talking about people's need to keep their money safe because "Yes, It's Your Money."

If you invested your money in the stock market, you probably lost 30% or more so far this year.

This is true for most people, myself included.

Another statement I totally agree with is where the host says that while yes, it's your money, most people spend more time planning a summer vacation than they do planning for retirement. This speaks volumes to the lack of any basic financial education in our schools.

The host then goes on to say if you invested his product, you would be earning 7.2% a year for ten years, plus a 5% kicker the first year.

7.2% in this climate? What do they say if it sounds too good to be true?

What is this product our show host is selling? He won't tell you. What he does say is the if your shoulder hurts and you call a doctor saying your shoulder hurts, the doctor will tell you he can't do a diagnosis over the phone......you have to come in to the doctor to get a proper checkup. Same as with his investment - you need to come in so you can sit down where he will show you his investment, explain what it is about and then you can decide if it is right for you.

Think Captive Audience - use care.

Looking around some more:

Maybe I couldn't find any information because the guy is really a doctor!

Or, maybe someone had a problem with him calling himself a doctor. After all, if you really were a doctor of something and you wanted to add all the legitimacy you could to your "financial" show, wouldn't you use it?

Anyway, back to the show.

A guaranteed rate of 7.2 percent for ten years...that is not anything to sneeze at and someone out in cyberspace you would think would be hawking the hell out of that.

I think I just might do a search:

That's as much as I could find on a guaranteed return of 7.2% and unless you are interested in foreign currencies...........

The second half of the show tells you for diversification, you can make use of life settlements.

What is a Life Settlement?

I am not going to spend much time on this, I've seen enough.

But then again try this on for size:

Joe, an ordinary guy is in his mid 60's, has a life insurance policy worth a cool million on himself and has fallen on hard times.

His life policy is in danger of lapsing because he can't make the monthly payments.

Joe has had this policy for a while and if he were to cash it in he might get $60,000 cash value, an amount far less than the one million Joe's heirs would get if he croaks. In Joe's world, circumstances are dire.

Enter the Life Settlement Dude

The Life Settlement Dude has access to policy information and notices the owned by Joe is in danger of lapsing.

Note: This is a good deal for the life insurance company because they don't have to make a payout on lapsed policies.

It is an even better deal for the Life Settlement Dude.

The Life Settlement Dude also happens to have his very own radio show where he pitches the wonders of life settlements and encourages you the listener to come on in and invest in one of these great products.

You make an appointment and listen to the Life Settlement Dude's pitch as he brings names and policies up on a computer screen with dollar amounts ranging from the thousands to millions.

You have a look through the policies and see Joe's policy on the screen, like the million dollar figure and ask the Life Settlement Dude how you can get your hands on some of that loot.

The Life Settlement Dude tells you the first thing you have to know is that Joe might be willing to sell you the policy if he was offered the proper incentive. The cash surrender value is $60,000 which is not all that much. If you the investor happened to have a spare $200,000 laying around, the Life Settlement Dude could give Joe a call, offering him $200,000 in cold hard cash if he was to sell his policy to you.

In return, you the investor would own Joe's policy and when Joe departs for the pearly gates, you stand to reap $800,000 - the balance of the policy. You'd be doing Joe a favor and for your generosity, you will be making a killing.

More or Less

The Life Settlement Dude informs you there are two minor details if you do buy this policy.

1. You the investor have to make the monthly premium payments on what was formerly Joe's insurance policy until Joe passes on.

2. There is a fee for the transaction in the form of a commission. The Life Settlement Dude gets a hefty fee - up front of course.

Before you make this decision there are a few other factors to consider:

1. Suppose Joe defies the odds and lives 20 years longer than anyone expected. You the investor are going to be paying premiums for

a long, long time.

Now, if you had kept the $200,000 and invested it for 20 years in GNMA's (Ginny Mae's), your money would have doubled twice over two decades virtually risk free and you would have @ $800,000, which just happens to be the amount you were hoping to get out of Joe's insurance policy....

Less the Monthly Insurance Premiums.

Less the Fat Fee to the Life Settlement Dude.

2. Suppose Joe has heirs, people he cares about and he one day hoped to leave a little something to make their lives a bit better. The Life Settlement Dude didn't bother to mention that you were potentially leaving his heirs with nothing when Joe took up your offer in a moment of ignorance or weakness.

3. The sooner Joe dies, the more money you make. How many premium payments do you think you could make before you end up wishing you had never heard of Joe and why over the years he hasn't got run over by a bus, hit by a meteor.......something......

4. Suppose you fall upon hard times and you are having trouble making monthly payments on Joe's policy. What can you do?

Don't worry. The Life Insurance Dude will come once again to the rescue and this time offer to bail you out.

Less Commissions and Fees, of course.

Basic Rules of Investing in the Real World.

1. Do not invest in anything you don't understand.

If someone has to explain it to you in the privacy of his office, at the very least get a second opinion.

2. If rates sound too good to be true, they probably are.

The higher the rate, the higher the risk. Been like that for years.

In today's climate if someone comes along and says,

"We were talking about a 24% return, a 15% return, a 33% return with no risk to your money", do you really think you are ever going to see your full principle again?

7.2% interest for 10 years - take a look around. Do you see anything reputable paying that?

- Less the rates offered in India, of course.

3. Radio Pitchman = Telemarketer with his own show.

Does a telemarketer have your best interests at heart? Extend that question to radio pitchmen in general.

They are all out selling their wares - selling product.

If you hear the word 'product', odds are some form of insurance is involved.

4. Don't tie up your money for uncertain time periods and consider your own age.

These sharks are out for people who have money and that generally means those who are at least 50 years old.

Suppose at 55 years of age, you bought a life settlement contract from Joe, who you stood to make somewhere around $800,000 from if Joe jettisoned his mortal coil in a timely fashion.

What if Joe didn't, confounded the actuarial tables and lived another 20 years?

Are you going to live another 20 years?

Something to consider.

5. Be Very Wary of Pitchmen Who Won't Take Calls on their Radio Show

This one ought to be a given.

Comparison Studies

#1

First for your consideration are two shows of 'Yes, It's Your Money.'

This clip is the second segment from a show that played in early December of 2008 - "Yes, It's Your Money 12/07/2008"

Now if you are like me, listening to this guy made my head spin. So wanting to be fair and all and waking up around 2:00 AM one morning, I decided to transcribe the show. It took me two days off and on. It was illuminating. You ought to try this if you feel yourself getting sucked into a morass of repetitive words. Listen to the .mp3 and then a bit later, read the transcript.

The transcript is here : "Yes, It's Your Money 12/07/2008 - Transcript"

Since I missed the entire show, I had a listen the following week and you know what (borrowing a Jerry favorite phrase), it was a cut and paste job. There were some items cut from the previous week and pasted into a 'new' conversation this week.

The .mp3 is here: "Yes It's Your Money 12/14/2008."

#2

Next up is a guy by the name Don Wales of Wales Financial out of Kansas City. No Photo Available.

The products he sells are Fixed Index Annuities and the latest is a Product X from Allianz.

He of course only has your interest at heart as well and he a considerable gaffe in the first minutes of the show.

See if you can spot it:

Don Wales 12/13/2008

I did some looking into Allianz and their annuity products. One thing I will say for them is that their disclosures are in layman's terms.

In one of the pdf's it states that buying an annuity within an IRA provides no additional tax deferral. Good for them.

Another interesting thing about these annuity products is:

Say you have an annuity worth $10,000 for 10 years at a guaranteed 7.2% interest and the first year you actually do get 7.2% interest,

giving you a grand total of $10,720 at the end of the year. Sounds pretty good.

Now say that at the end of year 2 you actually do get another 7.2% interest. The interest is only paid on the original $10,000 and not the

total value of the account, which is $10720. It makes a difference.

Compounded Compounded

Each Year only on the original

Over All $10,000

$10,000.00 $10,000.00

$10,720.00 $720.00

$11,491.84 $720.00

$12,319.25 $720.00

$13,206.24 $720.00

$14,157.09 $720.00

$15,176.40 $720.00

$16,269.10 $720.00

$17,440.47 $720.00

$18,696.19 $720.00

$20,042.31 $720.00

$17,200.00

Annuity Examples:

Product X

|

Simplified Annuity Contract Language reads as follows: I (the annuity client) agree to surrender some or all of my monies to an insurance company in exchange for safety, knowing that I will never partake fully in the profits reaped from market up ticks. I also realize that my money will never lose value in a down year because I am guaranteed a 2-3 percent interest on my account as a minimum (sometimes minimal interest will be less than inflation for the year but heck, for me safety is paramount). I also realize I will never be able to partake in dividend distributions from stocks because the insurance company keeps all that. While I am no dumb-ass, the contract language in the annuity insurance contract is beyond me but heck, the annuity salesman and the insurance company have only my best interests at heart,,,,,right? |

Annuity Grid

Here is an annuity comparison courtesy of a guy who also has an interest in annuities:

#3

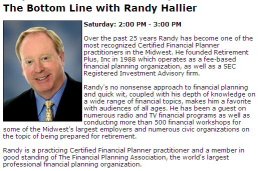

The Bottom Line is a fee based financial planning service organization and probably the most reputable of the three listed here.

Their claim to fame is a 'holistic' planning approach where they are a literal one stop shop for all your financial needs. The holistic approach is one where your attorneys, your money guys and your tax guys are all under the same roof, working in concert for your common good.

This reminds me of another individual in Nevada where he does all this and for large sums of money also functions as you very own personal 'Wealth Coach'.

Hours one and two are listed below. What was interesting was there was much conversation about fixed index annuities in the first hour, the primary targets of fixed index annuities and considerable information about same.

Hour 1

Hour 2

The bottom line here is yes, it's your money and please ensure you educate yourself well enough to protect against those who say they have only your best interests at heart. They are all peddling something and their primary interest is staying in business which means they all need to sell something to someone, and that someone may be you.

Caveat Emptor

May, 2009 Update

One criticism I do get on occasion is that if I am offering a rather critical analysis of an site or institution, that I don't do much of a follow through......and that is true. If something doesn't appeal to me the first time around, I doubt it will in future morphs. Kind of like the question, "What do you get when you spray a turd with gold plate? --- A gold plated turd."

I have not been rudely interrupted lately by a 'Yes, it's Your Money' hour long radio advertisement.Hmmmm.......What's up with that?

I think I might just have a click and see what "Yes, It's your Money" brings me this time.,,,,

Boy, that didn't work out too well, did it. There must be something out there in cyber space about all this.

I can't imagine this guy resting on his laurels.

Let's do a preliminary search...... after a couple minutes I came up with this:

Is this the same site, morphed into something else? I will let you decide that.

That's it......restrict commerce to make you feel privileged. I think I have again seen enough.

On Second Thought...........

Let's have a closer look at this web page..........Something here looks kind of canned to me.

Right-Click on this page and select View - Page Source (for You FireFox users).

And what is this? The entire Page? Yup. You are being redirected to QuickLister.com, and the ID of this particular Mr Bailey is 2295-2

What is Quick Lister.com? Have a look for yourself.

What is interesting is you can make up your own ID numbers and see what else is on this site. Substitute 2295-2 for 2295-1:

Or How About This One?

Or How About This One?

You know what one of the funniest things about all these people who wish to help you earn large sums of money, they all have the same businesses for sale too!

And the following must be a guaranteed money maker!

Yep, I'm going to hop on that Ping Pong Ball web site as soon as I get done editing this page.

I can't wait to make gobs of cash off of Ping Pong Balls!

Please.................do your own due diligence!