March

2007 Market

Timing Update

"There are

three kinds of people in the world: those who can count, and those who

can't. "

-Warren Buffett

Economic Growth

Continued slow to moderate economic growth this year.

Real GDP growth average of 2.3% over the last nine months of 2006

Estimate for real GDP growth in 2007 @ 2 - 2.8%

No signs of faster growth, which promotes very low inflation.

Real Estate

The inventory of vacant homes for sale in the U.S. now stands at it

highest level in over 40 years with over 2 million homes for sale.

It is expected to remain a drag on economic growth.

Fed Policy

No Rate Change from the current rate of 5.25%

Core inflation is 2% or less

Restrained monetary base growth has been restraining real GDP growth.

Reasons for seeing no

Bear Market

The put-call ration has a very high reading of .93, which means a lot

of fear in the market - a contrary indicator. While a

correction may

occur, as we are seeing now - no indication of a Bear Market.

Investing New Money in

the Market

Dollar Cost average or Buy on Weakness

Personal

Portfolio:

I suppose you could say we are in the middle of a correction.

No big surprise there.

A few further comments can be found here.

My personal allocations remain about the same with one exception.

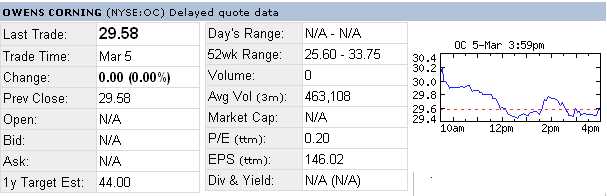

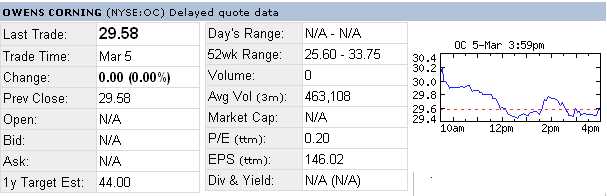

I decided to take a 4% position in Owen's Corning (OC). I

still view this as a good company which is extremely

undervalued. If you believe the latest Yahoo numbers, the company has a

PE of .2 with

earnings per share of 146.2.

Either way, I think this will add a bit of pizazz to the portfolio over

the year.

Todays Discourse: Annuities

In my view this is one of the biggest screw jobs ever to befall the

common investor.

What is an annuity?

An annuity is generally a product sold by an insurance company which

provides the holder a payout - usually monthly.

It is generally pitched to those approaching or in

retirement.

Annuities are tax deferred (remember this for later).

IRS's are tax deferred (remember this for later).

Distributions from both are taxed as funds are withdrawn. This can be

very expensive, particularly in an annuity.

There are penalties involved if monies are withdrawn before you reach a

specific age.

There are two types of

annuities, fixed and variable.

Fixed annuities guarantee a payment of a certain amount.

Variable annuities provide a variable return, which can be higher or

lower than a fixed.

These annuities provide a death benefit, which is one of the so-called

selling points.

The death benefit equals either the value of the annuity or the value

or the amount the owner invested in it.

The higher value is the benefit.

If you think your are doing you beneficiaries a service by providing

a benefit, you aren't.

Odds are you could be saddling them up for a nice tax bill.

Annuities should only be considered, and then only by an extremely low

cost provider (Vangard comes to mind),

when you have maxed out your other retirement investments and need to

shelter more income.

You should NOT ever

consider an annuity unless you have maxed out:

Your 401K

Your Spouses 401k

Your IRA

Your Spouses IRA

Your 403B

Your Spouses 403B

And don't forget about those SEP-IRAS

That's a lot of money - somewhere around $40,000

15k x 2 for the 401k's = 30k

4 or 5k x 2 for the IRA's = 8 or 10k

If you still have some cash you want to invest tax deferred, then maybe

a good, extremely low cost annuity.

Vangard comes to mind.

The better way would be to use good, tax friendly mutual funds.

Tax friendly mutual funds are generally index funds with very low

expense ratios.

Why?

Mutual funds charge operating fees and expenses.

Variable annuities are made up of mutual funds.

Variable annuities charge a maintenance fee on top of the expenses

charged by mutual funds.

This maintenance fee is usually 2 - 3 percent, which means your annuity

contract is getting dinged 2 - 3 percent every

year over and above the mutual fund expenses. Multiply this

out over twenty years or so, and the insurance company

is making a fortune off your money.

A good, low cost index fund may charge only .02 or .03 percent for

expenses because the fund is tracking an index of

stocks, the S&P 500 for example. There is no buying

or

selling in the fund other than what is required

to keep the 500 stocks that make up the

S&P 500 in

the index.

There is no fund manager buying and selling stocks to generate profit,

as in an actively managed mutual fund.

What would you rather pay as a fee, .02% or 2%, which is 100

times higher than the former?

Think good, low cost index funds first. DRIPs are even better if you

have the diversification.

With DRIPS, there is no management fee at all.

What about those taxes at

withdrawal time?

Index funds - 15%

Annuities - Your tax bracket.

ANNUITY SALESMEN USUALLY

DO NOT TELL YOU THIS

Index funds are taxed at long term capital gains rates, which at

present is 15%

Annuities - say you are in the 28% bracket, you get taxed at 28%

So, which would you rather pay:

$150.00 for every $1000.00 you take out.

or

$280.00 for every $1000.00 you take out.

It always helps to tack on a few extra zeros to illustrate the point.

Say you withdraw $2000.00 a month to live on, or $24,000 a year.

Cashing in low cost index mutual

funds:

$3600 is your tax, leaving you with $20,400 to live on.

Withdrawing from an Annuity taxed at 28%:

$6720 is your tax, leaving you with $17,2800 to live on.

That is an extra $3,120.00 you can either pay your self, or pay Uncle

Sam.

Those insurance salesmen will surely point out the fact that your money

grows in an annuity contract tax deferred.

They don't tell you how much it can cost on the other end.

If you hear any of these

pitches, run the other way:

I digress a bit. One radio show I like listening to is put

out by a guy by the name of Adam Bold, who runs a company

called the mutual fund store. He saves archived shows for a month on

his web site.

This guy makes no-load mutual fund advice his business and I think he

does a lot of good. While I don't necessarily

agree with his outlook and general hold / sell advice long term, I do

listen to an sometimes act on his

recommendations.

I would say every show, he has at least one or two calls from people

you got sold variable annuities for all the wrong

reasons. It is really deplorable what people to do people living on

fixed incomes. This show

has a couple examples.

It also highlights the fact that to this day, Investing 101 is not

taught in our schools in any substantial manner - and the

consequences of not knowing Investing 101 can affect the way you wish

to retire.

Investing 101 as a mandatory class could easily replace mandatory

foreign languages and would be far more

beneficial to the student in the long run than learning how to say 'I'd

like fries with that' in Spanish.

End of Digression

The Pitches

Tax Deferment!

Pitchman:

'Why not roll your IRAS

up into one of our variable annuities....'

'You

get the benefit of growing

your funds tax deferred!

Potential Victim:

'Well, I already have

tax deferment in my IRA's.

'Why would I want to put these into an Annuity?'

Pitchman:

'Ease of paperwork?'

- and he eases off to con the next mark.

New and Improved Death

Benefit! Bonuses Too - For a Limited Time Only!

Pitchman:

'We have this great new

annuity benefit which pays you even more

'than our

standard one! It is a

simple add-on guaranteed to increase

'your income and

you will leave more

to your loved ones as well!'

Potential Victim:

'Since this is an

add-on, does that mean it costs more?'

Pitchman: 'Well, er, yes..... but the

payoff makes it worth it!'

Potential Victim:

'What if I simply

increase my term life insurance policy?

'Wouldn't that amount

to the same thing and cost less?'

Pitchman: 'Well, er, yes..... '

- and he slinks off to scam next dupe.

Can't Afford an

Annuity? Think Twice! There's always your house!

Pitchman: 'Don't worry about about the

cost to get into an annuity,

'Look

at todays home loan

rates! You can get an equity loan

'and invest in one of

our fine products! It's worth it in the long

run!

Potential Victim:

'Uh, you want me to take

out a loan so I can buy your annuity which is going to

'cost me 5% for the loan and at least 2% to you for this

wonderful

investment

'opportunity? Am

I missing something here?'

Pitchman: 'You might have missed the part

where your money will be locked up

'for

7-10 years before your get

out of the penalty phase for early withdrawal...'

- and he slithers off to fleece the next victim.

No Load

Annuities!

Pitchman: 'Hey Listen, I know you're a

smart guy and we have the product just for You!

'Let me tell you about our

no-load

annuities!

'You pay nothing up

front! Just like

no-load mutual funds!'

Potential Victim: 'You mean there is no charge at

all? What about surrender charges?'

Pitchman:

'No fees at all! If you

invest in our annuity for 7-10 years!'

Potential Victim:

'What does it cost if I

decide to bail out after a year?'

Pitchman: 'If you decide to forgo the

benefits of our fine product in the first year then it will

cost you 7%.

'Paperwork charges, you

know. Each

year the cost to get out drops a percent but you won't have

'to worry about that because we're a solid company!'

Potential Victim:

'Well, uh, that sounds

kind of like a back-end loaded mutual fund doesn't it?'

Pitchman: 'You know about those?'

- and he skulks off to engage another target.

I suppose by now you have the general idea as to where I stand when it

comes to annuities.

Three thoughts in closing:

1. If you want to invest, use standard investment vehicles - mutual

funds, stocks, bonds.

Insurance contracts are not investment accounts.

2. If you want insurance, buy insurance. Have a look at Term

Insurance.

3. The only persons who usually have a genuine vested interest in

annuities are those selling the annuities.

They live off the commissions, which means they

are living off of you.

Back to the grind.