I have been mulling over a couple other things recently and have some comments about same,

so this may be rather lengthy.

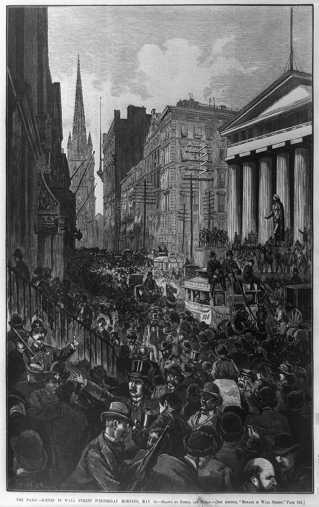

I don't think this blip is a big deal.

I also think it has the potential for extending the bull market.

Here is why:

|

About that

Market Hiccup... I have been mulling over a couple other things recently and have some comments about same, so this may be rather lengthy. I don't think this blip is a big deal. I also think it has the potential for extending the bull market. Here is why: |