Western Lithium - Another Organo Clay Delay at the end of this Month?.............of Course.........

I

was kind of thinking about a year-end surprise insofar as some positive

news coming out regarding the manufacturing of organoclay and

subsequent contracts but that never happened. I picked up a

few more shares in the low 50's, which is now my cost basis. They

say no news is good news and while that is generally true, no news when

it comes to penny-stocks usually is accompanied with a slow

deterioration in share price, which is what is happening now.

Personally, I am putting in some sell orders for about half of

the investment staggered up to providing a 20-30% return should a

knee-jerk reaction upwards happen upon the release of any good

news.

Those knee-jerk spikes usually don't last long at all - sometimes for

only a matter of minutes and if you don't have any limit orders in, it

is very easy to miss out on those short money-making opportunities.

Staples (SPLS)

I

thought that if I held on to Staples long enough, it would be a winner

but I never expected it to be the portfolio winner for the year.

At a 50% return, the only other holding that came close was AAPL.

I am not sure why the run-up, other than on rumors and speculation, but

I'm not complaining. The PE and yield are still reasonable so I

think this is worth holding on to for a while longer. I don't

think I would be adding any new shares, though.

Materialize - a Recent IPO and not a Winner

I

invested too much in this IPO. Materialize is in the 3D printing

sector, selling software rather than printers and I thought given the

areas it was involved with, health care in particular, that this would

be a money-maker.

Maybe it will over time, but I ended up selling half at a loss and am letting the other half ride for the time being.

At these prices if one wishes to do some speculating, the current

share price looks attractive but I am not picking up any more shares.

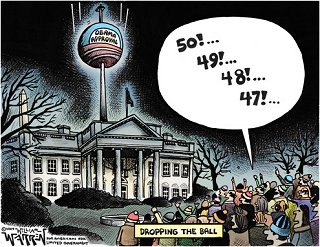

Nevada Copper (NEVDF) - The Perils of Trading in Thinly Traded Penny Stocks.

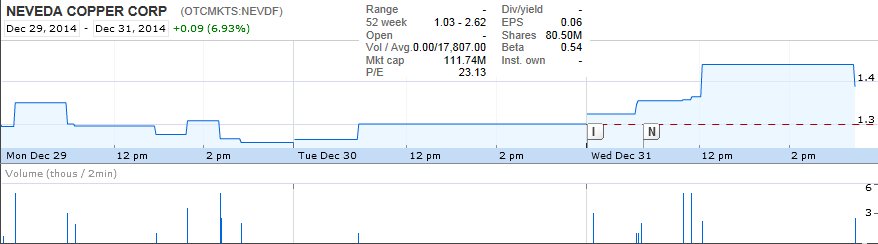

Believe

it or not, the Lyon County Land Bill passed, the teleprompter signed it

and everything was good to go. The share price barely bumped up

and volume was far less than what I would have expected.

Around the beginning of December, the share price of $1.15 and

change was too much for me to pass up. I figured that any good

news would get me a nice return (on those shares anyway) of 20% or so

if I didn't get greedy. Three weeks later my target price was

there, but the share volume wasn't. I was trying to sell more

shares than what was being traded.

Then for no reason I could find, on December 31, the price and volume

started spiking. I was finally able to off-load those shares for

a return right at 20%.

The remaining balance of the shares shares I am holding are still down

13-30% but I am not too worried about that. The price of

commodities in general does have me a bit concerned but when you are

dealing with penny-stocks, reality does not often factor in

when it comes to price movement.

Either way, this year I am looking to lighten up on the cheap stuff and

remove some of the volatility from the overall portfolio.

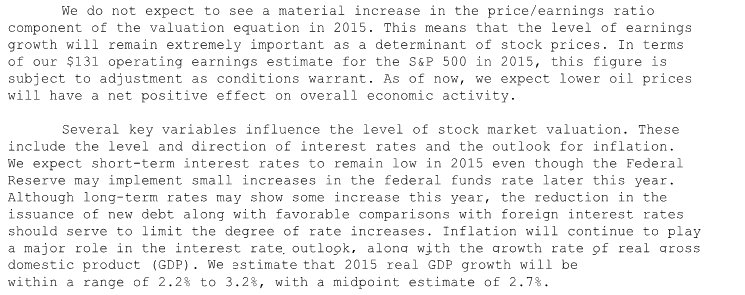

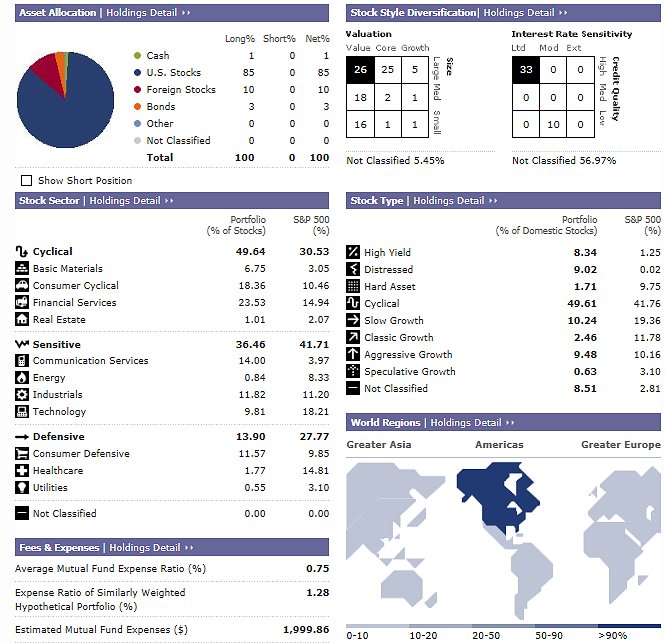

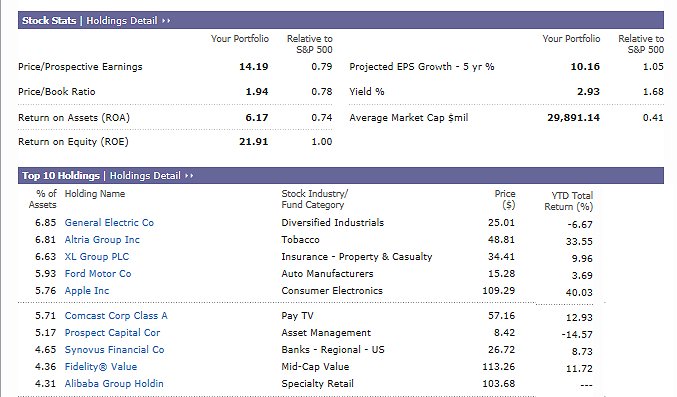

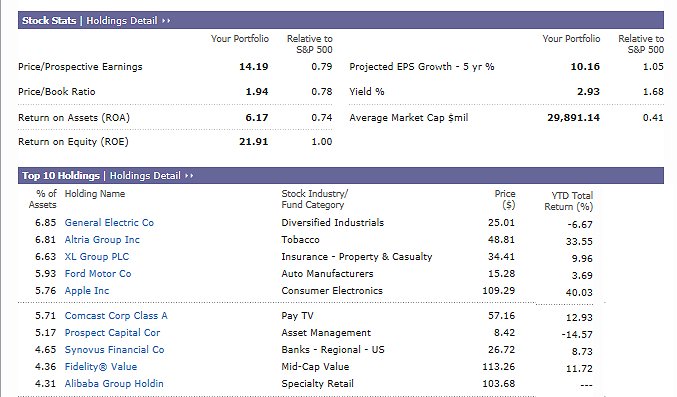

Instant X-Ray Year-End Review.

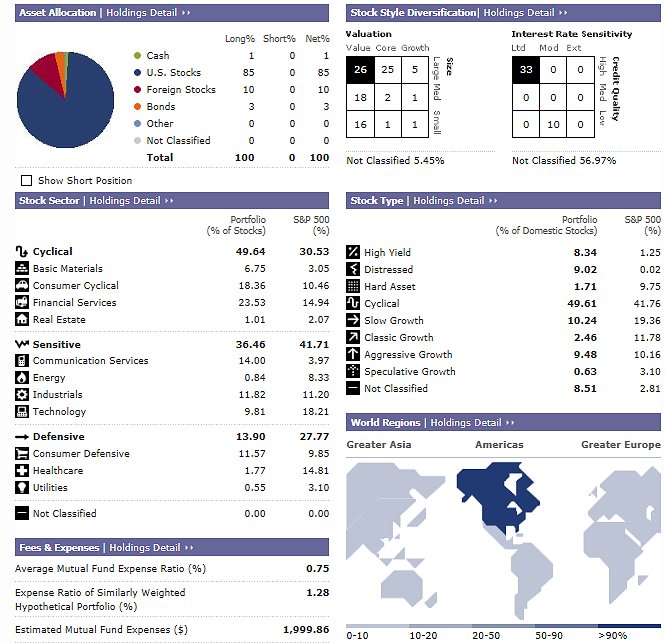

Morningstar's Instant X-Ray is a great way to

evaluate how your portfolio is weighted and I try to use it once a

year. It can be an eye-opener especially when your portfolio

consists primarily of mutual funds or ETF's.

49% cyclical with an emphasis on financial services is a good place to

be if you think the economy is in recovery, albeit a slow one.

I'm overweight in communications and underweight in tech. This is

because I think communications is a no-brainer and conversely, I am

lousy at picking tech stocks.

Health care is another one I have never had much luck with and the investment mix reflects that.

Utilities.........If I really wanted to get into that, An ETF or mutual fund would probably be my first choice.

The stock stats look fine to me and I plan on keeping them using this general mix.

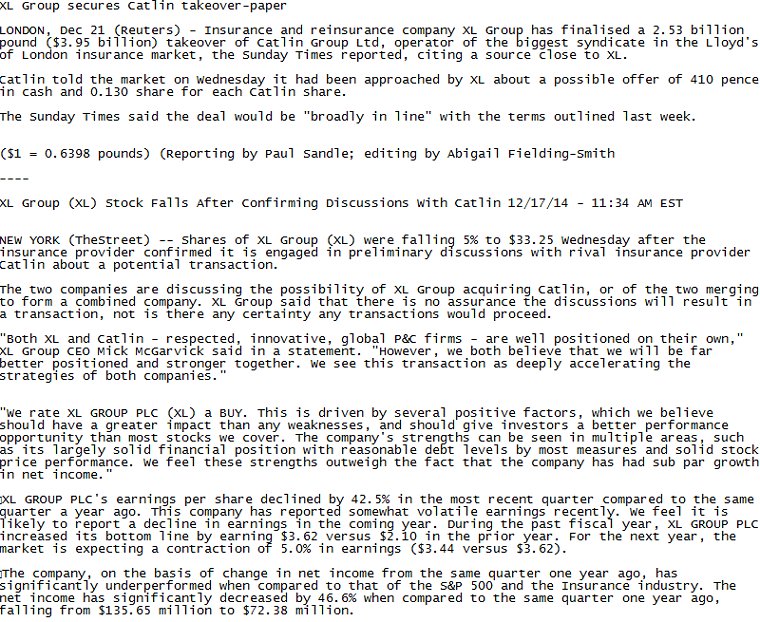

One Final Observation: XL Capital (XL)

XL Capital is an insurance company now based in Ireland

and is a long term holding of mine. Generally you don't see much

in the way of news regarding the company and it typically flies well

under the radar screen. Over the last couple months there has

been more news blather than one typically sees for a company in this

industry.

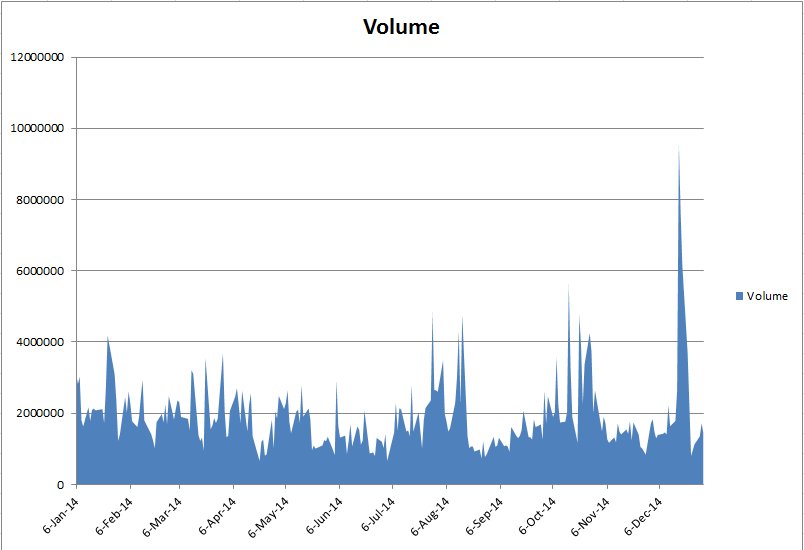

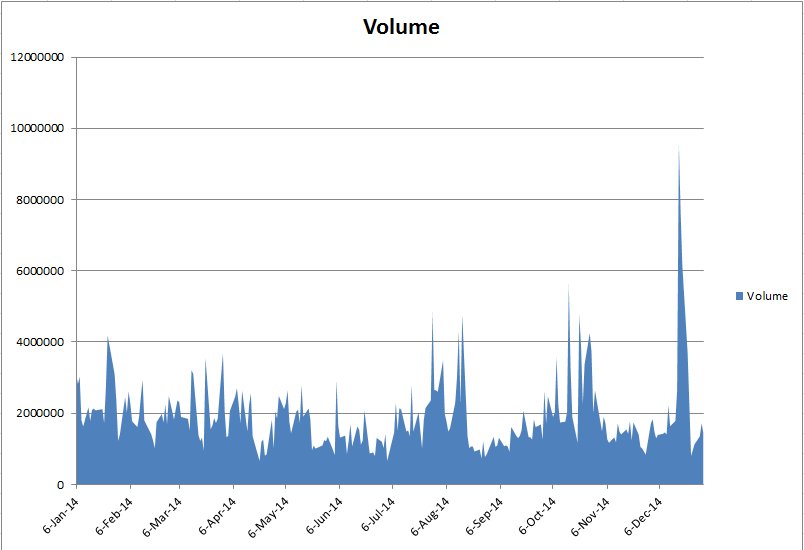

Volume has been picking up over time and in December, there was a huge

volume spike, which was probably the result of acquisition / merger

talks:

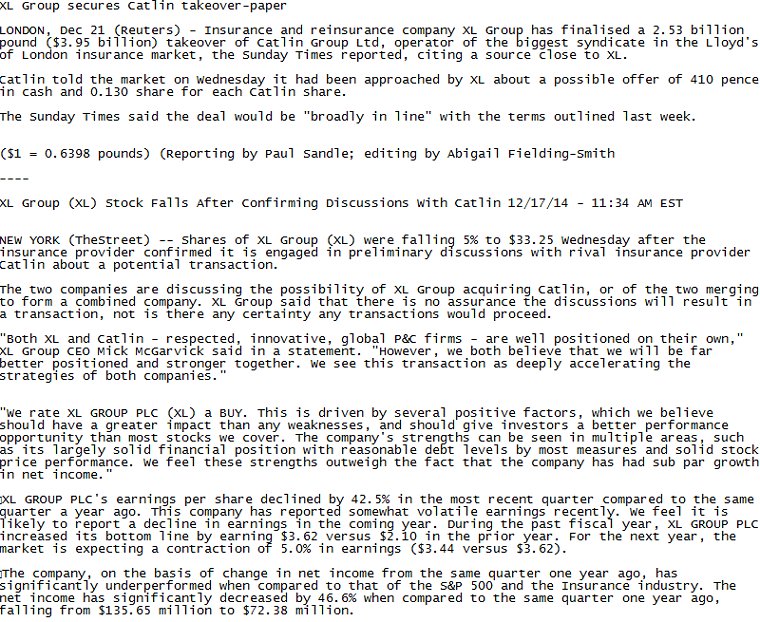

Snippets from a real article and ones from a computer-generated news

release seem to me to tell a more negative, than a positive story.

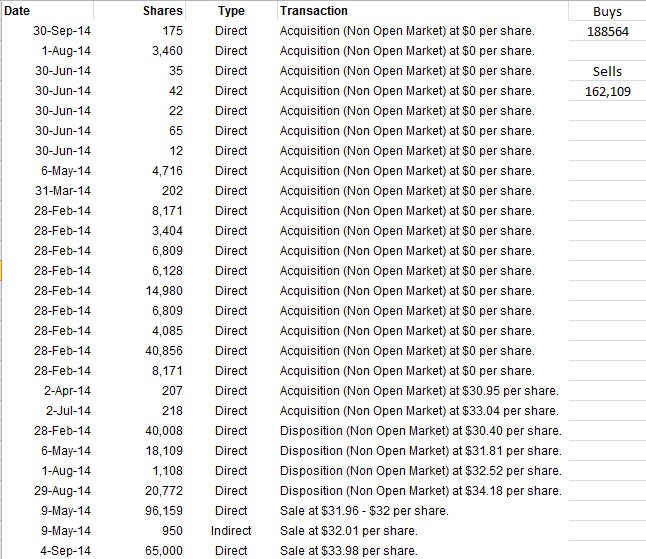

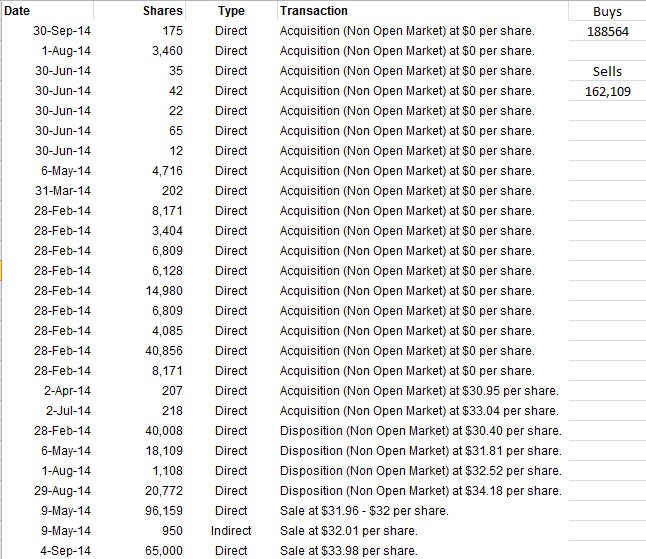

Looking at insider buys and sells over the last year, it appears

there has been more buying than selling and the selling involved two

major transactions which could have been for any reason. There

were more buys at the beginning of the year than at year's end.

This seems to me to conflict with the overall opinion one sees in the

news.

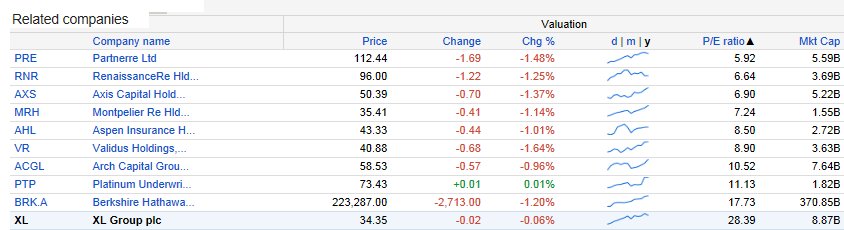

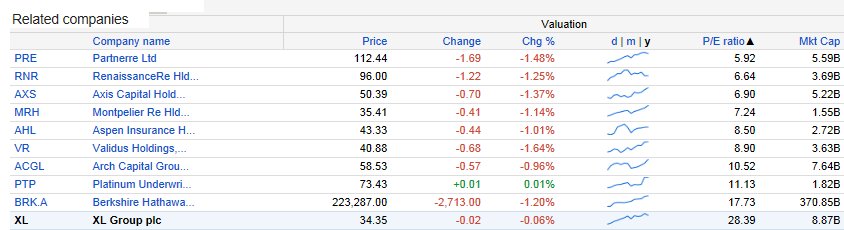

Valuation as compared to its competitors is high, however YOY it has lost less in share value than similar companies.

I don't know what all this means but it does seem XL is on someone's radar screen and it is garnering more attention than usual.

Might be worth a little speculating just for the heck of it.

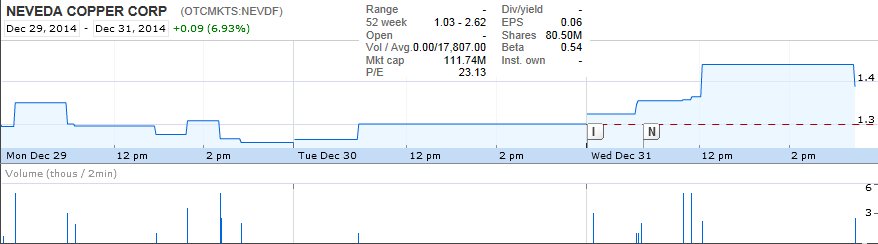

And last but not least, the Capitalist Pigs latest Monthly Newsletter.

This newsletter deals primarily with the decline in commodities and is a good primer on same.

One thing......don't pay attention to the charts if they are

confusing (I am not a chartist so sometimes they are).

Ignore the charts and read the text, which makes a lot more sense to me

than the charts often do.

A fine winter day at the DIA

|