| December, 2013 - Year End "Church ain't over until the snakes are back in the bag." ~ From 'Out of the Furnace' |

|

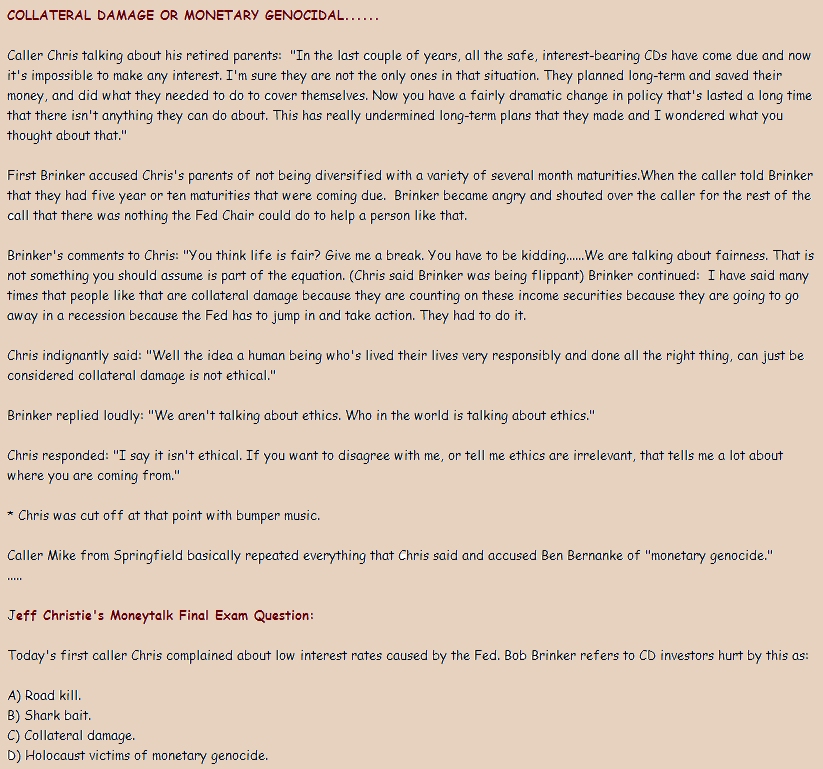

The Professional Opinion - DJ 16576.66  (A Radio Conversation in which I don't think Bob did himself any favors)  Buy Recommendations NAESX Sell Recommendations PRNHX  Welcome to 1984 |

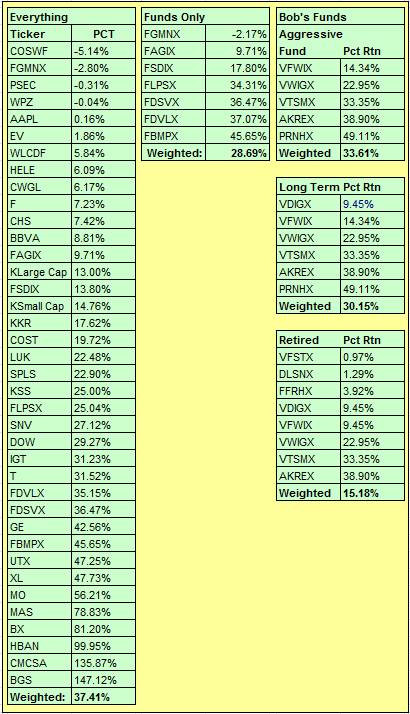

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. |

Looks like the Fed got it right this time around with its Taper decision. The Fed reduced its bond buying program by 5 billion a month and that seemed to satisfy the Taper Doves by such a small reduction and it also seemed to make the Taper Hawks happy in that the Fed at last started to Taper. Not bad at all! For a teleprompter bent on punishing the 'Haves', it is not doing a very good job but.... one must remember it is only a teleprompter.  |

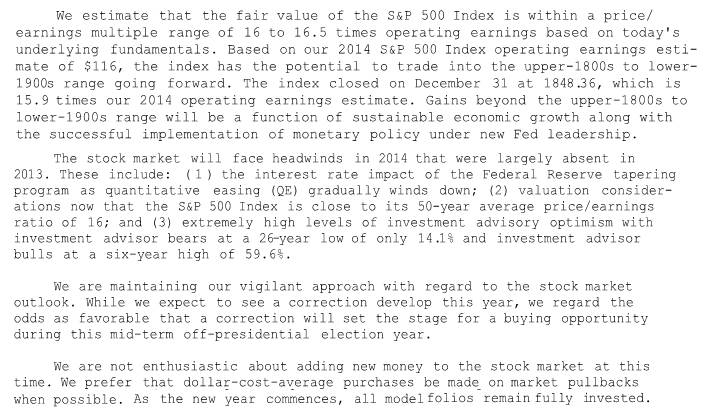

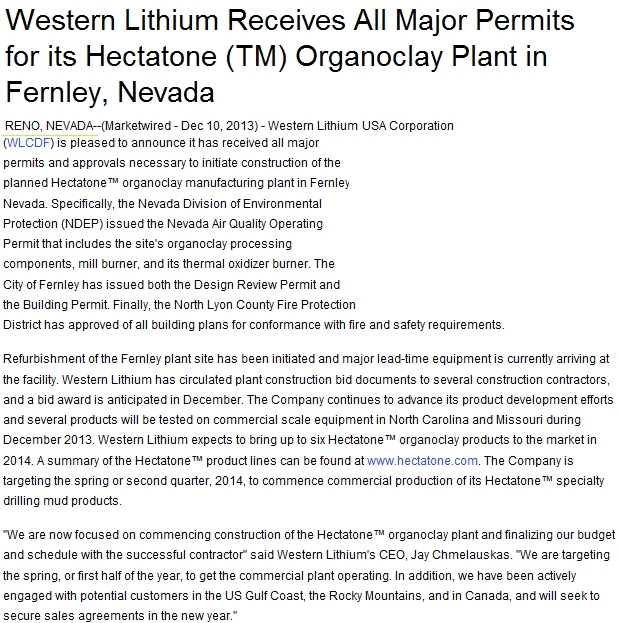

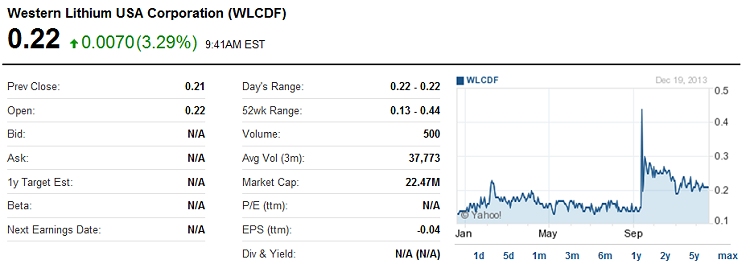

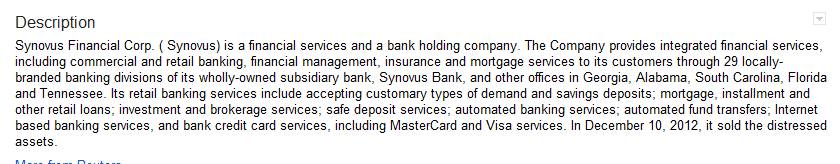

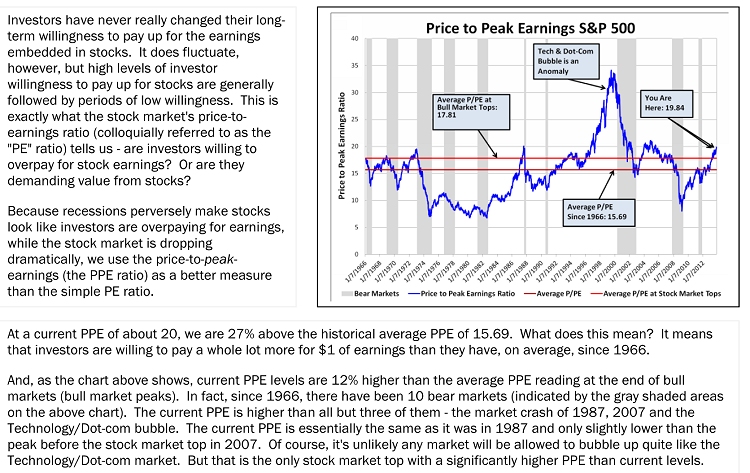

Time to Speculate again, I think.   Well well, Western Lithium is making headway. I may just have to make a drive out there again. It's looking like the share price is not going to go below 20 cents a share anytime soon . I haven't heard whether or not the BLM has issued permits for anything more than exploratory drilling and testing but I would think that if WLC is going ahead with major equipment purchases with Fernley permits in place, those BLM permits should be forthcoming. I'm not buying as much as I did last time, but certainly enough to goose a couple of the retirement portfolios. SNV - It's not too Late   Synovous is a smallish regional bank which I accumulated in the 2's and low 3's. At current prices I still think it looks attractive. Synovous was one of the banks that had to take TARP funds to stay afloat and they repaid those funds late last year. Valuation looks quite attractive but there is a question of growth in these current economic conditions where homes are out of reach of many, and Blackstone is the United State's largest landlord. However, interest rates on the 10 year have been creeping up and higher interest rates overall, will mean more profits for lending institutions. I don't expect to see much more than slow, steady growth and that's ok with me. If one factors in a fair PE valuation of say 16, that would suggest a future value sometime down the road of around of $14.00 using the current EPS. When and if the stock goes over $5.00 a share and they increase their dividend to more than the current single penny every quarter, I think there could be some nice share price appreciation. Financial institutions in general: I am staying away from the big banks due to concerns about teleprompter interference and the new Basel restrictions and all the lawsuits. I am currently overweight in the financial sector and it breaks down like this: Tradable Large Bank: BBVA - (Volatile enough to get some nice price spreads) Regional Banks: HBAN, SNV Large Private Equity Firms: BX Medium-Sized Private Equity Firms: KKR Business Development Companies: PSEC (Functions much like a REIT) Investment Firms: EV Insurance: XL Smaller Regional banks, private equity firms and business development companies are not subject to the same restrictions as the large banks are and can make loans where the large banks cannot. The sector has been producing some nice returns and I expect it to remain this way for awhile. What are the Capitalist Pigs thinking about all this?  Chris Butler is a portfolio manager with Butler Lands and Wogler, a Kansas based investment advisory group and the main commenter on the Capitalist Pigs show which airs each Saturday at 0800. He investment method used the business cycle, and where we are at in it. The philosophy provides a different perspective in that it actually utilizes thought, and not knee-jerk opinions and reactions. For a while now, he has been saying that the markets are over-valued, and at some point earnings are going to have to match the value of the underlying equities or, equities are going to have to match a reasonable PE for the company stock. Chris is not saying when, but sooner or later he says it has to happen. Me, I think he puts a little too much attention to charts. He must mention that you have to look at this or that chart about 100 times during the one hour show (36 minutes excluding commercials). While I agree that stock prices are being driven in large part due to easy money and the tapering effect, that doesn't mean that those two points should be the only thing which might motivate one to sell everything and go to cash. The Capitalist Pigs aren't saying that either, but their implication is that the market is way over-valved if you look at the stock and earnings, present or future per share. My attitude is more to make hay while the sun shines. Snippet from the Newsletter: .......In conclusion, this is the rub for equity investors: if earnings on the S&P 500 drop by 19% over the next four years, it puts the earnings per share of the S&P 500 at $73.67 per share annually. That's down 19% from today's peak earnings of $90.95. But that kind of reduction in profits would almost certainly mean we have entered a bear market in stocks. The average bear market low PPE since 1966 is 10.74. That means investors, at the bottom of the last 10 bear markets in stocks, have only been willing to only pay 10.74 times the previous peak in earnings to own stocks, on average. 10.74 times the peak earnings (which would be ostensibly today's $90.95) equals an S&P 500 value of 976.80. That would be a drop of about 46% in the price of the S&P 500 from today's level. Let's be clear, there are a whole lot of "ifs" in this thought experiment. And, the likelihood of a scenario playing out exactly this way is quite remote. But the point is this: corporate profits are mean reverting for logical, economic reasons. When stocks must drop some 46% to be considered a "value," you can be sure that there is a higher than average amount of downside risk in this market. Particularly when this stock market is the most leveraged of all time. Yes, you read that right - of all time. And particularly when the number of stock market bears is at an all-time low (another mean-reverting situation that's bearish for stocks). What this means is that everybody is on one side of this stock market with leveraged bets on its continued ascent when corporate profits are extremely high, in an environment where households and the government are reducing their five-year gift to corporate America - their profligate spending. There is risk in this market. Caution is warranted. No, there is no telling when, or even if, the market dives. Hopefully, the fundamentals catch up to the market in a smooth and easy transition period. And, surely, over-valued markets can become even more so. The point is that, yes, this market is over-valued, and such valuation levels are dangerous. Anyway, here is the latest BLW Newsletter. I think it is worth getting another perspective but, I would hazard a guess that my returns YTD are considerably better than theirs.  Not exactly a nice, winter pic but one of a fine, Dog Day afternoon. |