Personal

Portfolio

Decent Month, all in all. Time for some changes though.

|

Change got here........Now What?

The thing about conservatives for the past few decades

is that they have been pretty much spineless - no backbone at

all, except when it came to passing social initiatives under George

Bush.

There is still no tax policy. The Libs are

still whining about taxing wealthy Americans more and Conservatives are

intent on passing an 'All or Nothing' plan, and in the end, there is no

plan.

I am somewhat worried about this and I think that any

American who relies on dividend distributions as a part of their

monthly living allowance should be absolutely up in arms about this

definite lack of leadership in the house and in the senate.

|

|

Personal Portfolio

The Change: Annaly Capital Management (NLY)

I mentioned this stock once before. I held

it for a while and then chickened out (that would be somewhere in May).

I shouldn't have. I should have held the stock. Next

week I am buying back in and holding for the long term.

I was surprised when I learned this stock even got a Cramer ShoutOut.

Given

my age, I have slowly been moving $$ into more stable stocks.

While several years ago, I was primarily interested in really

broad diversification and accomplishing that by using mutual funds,

I am now more of the Warren Buffet mind in that if you want

extreme diversification as a form of protection, then you obviously

don't know what you are doing.

These guys also put out some really good commentary. Takes some work to understand some of it though. November Commentary.

Anyway, I think this stock is worth 4-5% of the portfolio, especially in the tax-exempt portion of your account.

The Winner: for more than likely the rest of the Year is...........

Standard Pacific Homes (SPF)

With the inclusion of dividends,

B&G foods returned almost 40% this year. Of course, I

have to take into account the fact that I sold it at a high during a

Cramer ShoutOut, and then bought back when the stock returned to

normal. This is a well run company, always on the lookout for

brands which have fallen out of favor. I am very happy with this

company and am entirely surprised with the end of the year results.

Anyway, this is a company that I think one would be

quite content with over the long term, considering the current

management.

The Bizarre.........

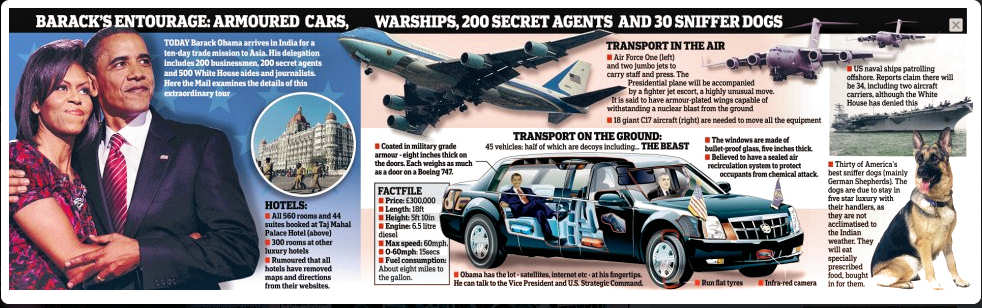

This self-obsessed,

aristocratic moron has absolutely no clue as to the state of the

economy for normal folks and needs to be sent packing to the role of

that as community organizer in Nowhereville, KY (no criticism of

Kentucky intended).

The Loser: BAC - Bank of America

I

finally gave up and sold most of BAC. I am now holding only a

token amount. I think there are better places to go.......

The Replacement: Ford (F)

I

bought this in the low 14's and am content to sit on it. It has a

reasonable PE, sales are strong overseas and it is not government run.

Should it be declared illegal to turn a Profit?

I

try to stay out of politics, especially when it comes to family

get-togethers but when a public service employee starts shooting his

mouth of about the evils of big business and how the government should

keep its boot heel on the neck of big business, that's going a

bit too far.

Public service employee wages are paid by those of

us who work in private sector - you know, the risk takers - the people

who start companies and hope to generate business. By generating

business, these people provide jobs. The bigger they get, the more

people they hire. The more people they hire, more taxes are

paid,

Public service employees can be

considered as burden or overhead on the rest of us. Of course a

certain amount of burden is necessary for a functioning society and I

have no issue with that but I do get sick and tired of those in the

public sector mouthing off against those that pay their salaries - can you say hypocrisy?

You hear more and

more of this kind of crap - especially under the current

administration. It does make one wonder if we should not have a

national debate as to if capitalism should be declared legal or

illegal once and for all. I think some of these public service

employees would much rather have a form of limited capitalism where

they can keep their boots on the throats of business by making it

lawful to earn only so much, sending any extra to the government

where they can 'spread the wealth around.'

Gee, that sounds kind of familiar doesn't it?

............and look where it has got us.

Storms are coming early this year. |

|