December 2007 Market Timing Update

"Budget: A mathematical confirmation of your suspicions "

December 2007

Market Timing Update

"Budget: A mathematical

confirmation of your suspicions "

~A.A. Latimer

| The Professional View The timing model remains in bullish territory and in light of the correction which began in October, it is time to examine other short term corrections in the recent past, Since March of 2003, there have been five market corrections of at least 7% as measured by the S&P 500 index: Dates %Decline Duration 02-11-04 to 08-06-04 8.1% 176 days (I remember this one well) 03-07-05 to 04-20-05 7.2% 44 days 05-05-06 to 06-13-06 7.7% 39 days 07-19-07 to 08-15-07 9.4% 27 days 10-09-07 to 11-26-07 10.1% 48 days Excepting the first correction in 2004, the other corrections were less than two months in duration. Each one of these corrections was accompanied by high levels of volatility, investor anxiety, emotional and irrational decision making and a plethora of negative news. This correction was no exception. Anyone adding extra funds during minor pull backs in the mid S&P 1400 range will likely have made a wise decision. The 60-day put / call ratio has another high reading of .98, which is a positive for a bullish market going forward. The copyrighted sentiment index has a reading of 130, which is well above its bullish threshold of 100. Bob is a happy camper going forward and expects to see new highs going into 2008. He also references the rapidly expanding numbers of forecasters and analysts whipping up the r-word frenzy where they fail to distinguish the difference between a short term correction and an economic recession. I liked this from last month: "...we view the cacophony of financial media stories on this subject as highly suspect." Bob ends the letter with analysis of market conditions in general. Indicators Economic Growth Out of all the indicators out there, the monthly new jobs report is one of the most important. The jobs numbers coming in are adequate to fuel slow to moderate economic growth. The devalued dollar is significantly helping maintain strong US exports, which is also helping in keeping the numbers of new jobs on the increase. High energy prices and the housing recession are putting the brakes on runaway consumer spending. People can't use their home equity as an ATM machine anymore and most of them still have to drive to work. Even in these conditions total retail sales has risen 6.7% year over year. Fed Policy With the national elections coming up, remember that the Fed usually goes into a holding pattern when elections get close so as not to appear biased in any particular directions. A fed funds target rate is likely to remain in a range of 3.5 - 4.5 percent. The housing recession will also provide additional incentive to further ease rates. Inflation Annual Core Inflation is 2.2% and doing fine. Headline Inflation is expected to remain within a range of 3-4% mainly due to high oil and energy prices. Economic growth is likely to continue slowing down and this will keep core inflation in check. Interest Rates Long term interest rates are expected to remain in the 4.5 - 5.0% range if the expected real GDP numbers going into 2008 are correct and the core inflation numbers remain as published. Portfolios No changes to portfolios. Summary The market looks to set new record highs going into 2008 with slow economic growth, low interest rates and low inflation. The volatility we have seen in the recent months will continue. Short term corrections are health restoring for a continuing bull market. Serious investors realize that market gains and volatility go hand in hand. Weak investors will continue fleeing the market during short term corrections. Dollar Cost Average in for new money if you don't see a buying opportunity drop in the S&P mid 1400's. Bob is staying Fully Invested. |

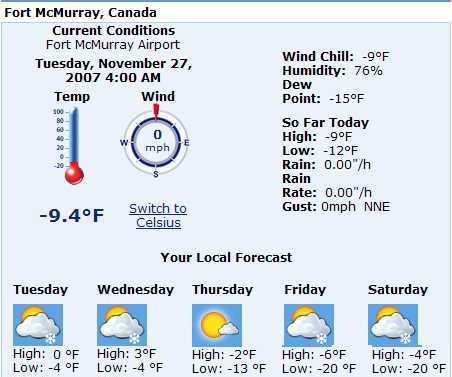

| Personal Portfolio How is life in the Yukon......again........? See Below.  October - November sure were trying months, weren't they. I am still holding to my prediction of a bang-up year but we have some ground to make up. The financial shows are going into overdrive banging the R-word drum. The R-word - anyone out there have a good definition as to what exactly constitutes going into a recession? Two consecutive quarters of negative GDP growth of negative ten percent would qualify as a recession. Where are we at? Real GDP for the first half of the year was about 2.2%. Third quarter Real GDP was @ 3.7%. Not exactly precursors to a recession. Economic weakness going forward - looks baked in the cake. A recession in the near future? I don't think that is likely at all. What do I do during periods of extreme volatility? Not much of anything financially. This last time around I knew we were correcting and in a significant way but I didn't know the extent of the correction until a couple days ago because I haven't been paying that much attention the last couple months. Sort of been distracted by long periods of sub-zero temperatures as well. Anyway, With news and video available 24/7, it is very easy to get caught up in the crisis of the moment. Do that, start making emotional decisions instead of rational ones and watch those gains you made over the years evaporate. I heard the other day there is now a new medical condition for those who stay glued to news stations from sunrise to sunset, and the distorted lens they see life through. I don't know about the medical condition thing, but I do know perpetual bombardments of bad news, fear mongering and the like can certainly color ones perspective of the world at large. Plenty examples of that close to home. Out of curiosity one day I picked a random financial news feed and stripped out all the words / phrases with negative connotations. I wasn't left with much of an article. Here are the negative words from that one article:

Now I am no psychologist, but it isn't much of a leap for me to imagine that nothing good can possibly come from reading articles like this and listing to teleprompter babble with the same slant day after day. Anyone out there needing to do a term paper on social trends, controlling the masses or the impact negative media blather on the psyche at large? Might make for some interesting research. I was amazed at the number of financial institutions holding junk paper in money market accounts. Shades of the Dot-Com debacle. I guess all that money we are sending to the middle east does have its advantages - at least for Citi Bank. Why in the world would someone use sub-prime paper to boost money market fund returns? Isn't anyone out there managing risk for these companies? It looks like all that money heading east is going to do some serious investing in housing related stocks as well. As bad as housing and financials have been beaten up, they may have a point. Speaking of housing stocks, if you have several accounts and do some trading periodically, it does pay to carefully review what you are actually holding. I thought I sold all my DHI some months ago. I didn't. My remaining shares lost at least half their value and the only saving grace was their nice dividend payout. That too is going by the wayside because DHI is talking about drastically cutting their dividend to help bail themselves out of their current position. It wasn't a big loss, but one that could have been avoided by paying more attention to accounts I do very little with.

So how is life in general? I am reminded of the story of Joe and Bob. Joe is standing on a street corner reading a paper and waiting for the bus. Bob walks up to Joe and asks what the easiest way is to get across town. Joe tells Bob the easiest way is to buy a ticket, board the bus which is coming along shortly and ride across town. The idea of getting on a bus intimidates Bob so he walks across the street and rents a car. Bob gets in the rental only to find it has a clutch instead of an automatic transmission, and he doesn't know how to use a stick shift. Bob decides to call a tow truck and have the car towed across town while riding in the cab with the driver rather than face the embarrassment of returning the rental which he can't drive for one that he can. Bob sits in the cab silently fuming about all the money and effort he has expended trying to get across town when all of this could have been avoided if only Joe had been more helpful. A friend of mine upon reading this informed me that I didn't get the analogy quite right. He said if he was me, life would be more like this: |