| October, 2013 "As democracy is perfected, the office of the President represents, more and more closely, the inner soul of the people. On some great and glorious day, the plain folks of the land will reach their heart's desire at last and the White House will be occupied by a downright fool and complete narcissistic moron. ~H.L. Mencken Note: H..L. Mencken (born 1880 - died 1956) was a journalist, satirist, critic, and Democrat. He wrote this editorial while working for the Baltimore Evening Sun, which appeared in the July 26, 1920 edition. |

|

The Professional Opinion - DJ -------------- Taking a Subscription Vacation this Month so how about this:  Buy Recommendations I think it's safe to say that everything is rated 'hold'. Sell Recommendations I wouldn't imagine there are any.  The cynic in me would have to think this is an invitation to the 'Religion of Peace' to join the social media frat party and one more reason for me not to bother. |

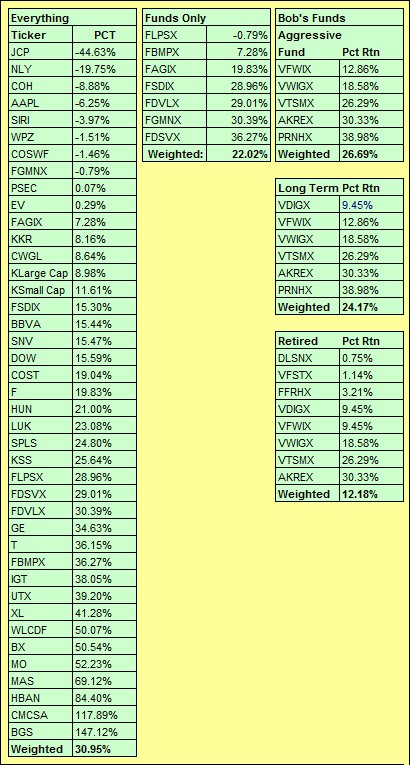

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. |

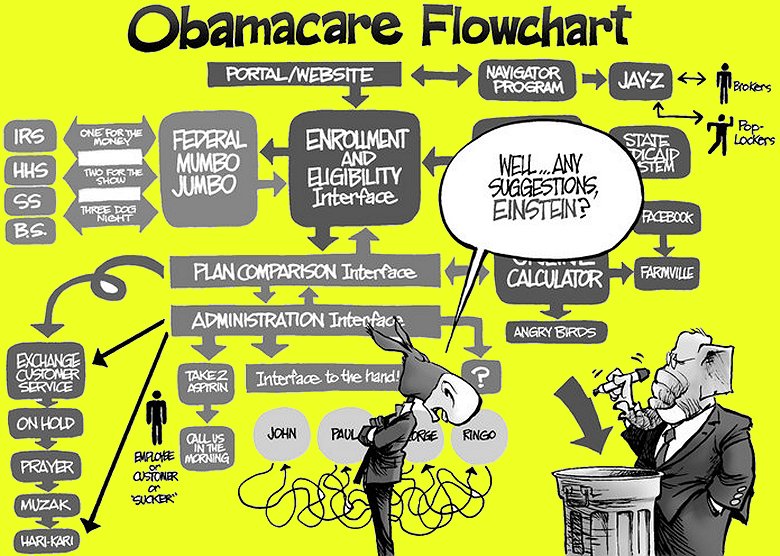

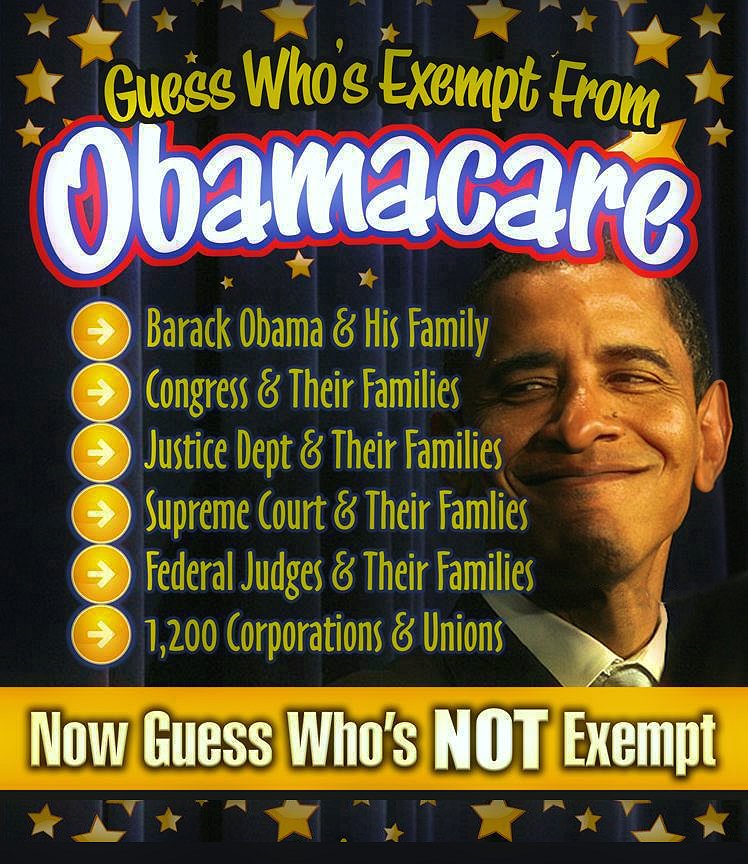

Once again the teleprompter, congress and the senate took the debt ceiling debate up to the last minute, with the teleprompter using the park service to inconvenience as many of the Proletariat as possible in another disgusting display of arrogance, ignorance and incompetence. I'm going to hazard a guess that an administration focused on anything other than improving the economic picture and further complicated by the headwinds of socialized health care, is going to be stuck in a rut until the mid-term elections. Add to that a Fed that is inflating the heck out of stocks in an effort to avoid deflation while a totally dysfunctional congress and senate do nothing but vent vast plumes of gas, and I can foresee 'quantitative easing' for months to come.  |

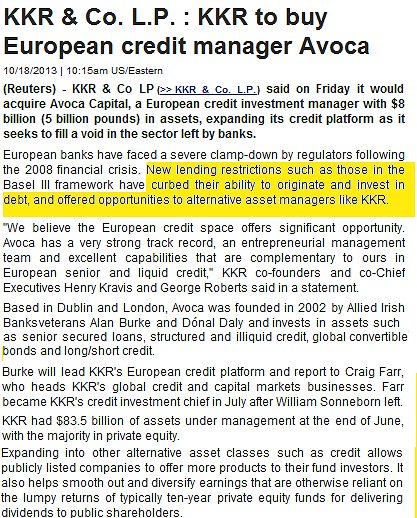

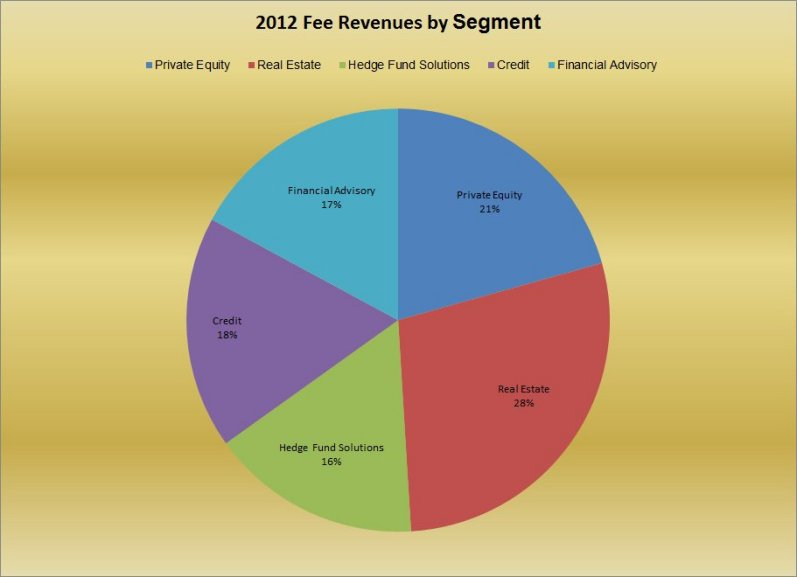

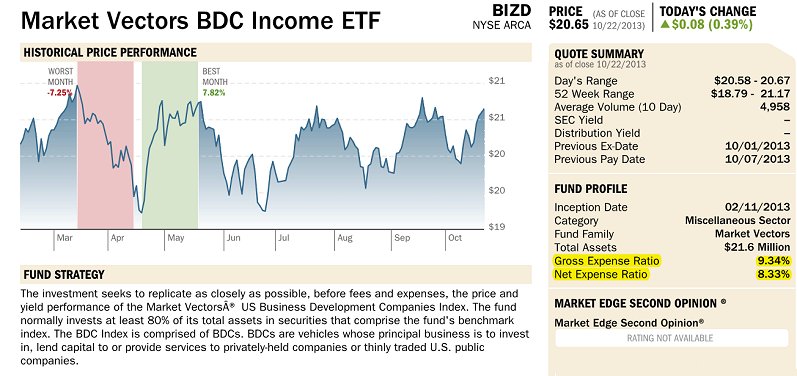

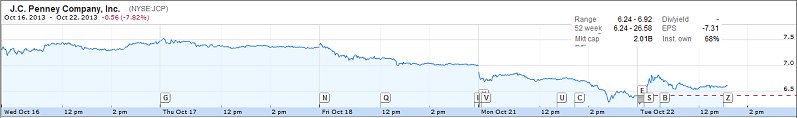

An Upside to teleprompter inspired Bank Lending Problems........... Private Equity / Alternate Asset Managers! Cases in Point:   I think it's worth profiling this class again. Private Equity Firms (BX), Business Development Companies (BDC's) and Alternative Asset Managers (Private Equity) are the places one turns to when more traditional sources like banks, are hampered by either their charter or by the pernicious tentacles of the teleprompter administration. The group is doing very well, as am I. KKR is a fairly recent addition, up 8% from where I bought it less than 2 months ago. They have a nice dividend and are expanding more into Europe, where credit is still a problem. One last thing to consider is the tax consequences of owning an LP or MLP, particularity in a taxable account. It is best to go to the horses' mouth for that kind of information. Here is an Example from KKR - KKR-Tax Faq  Blackstone, well, what can you say about Blackstone. This is a private equity firm which invests heavily into real estate and has had a terrific run. Analysts now have a $30.00 price target on the stock. I think in light of the current government dysfunction, companies of this type are going to do well going into 2014.  One last thing to consider is the tax consequences of owning an LP or MLP, particularly in a taxable account. One last thing to consider is the tax consequences of owning an LP or MLP, particularly in a taxable account.It is best to go to the horses' mouth for that kind of information. Here is an Example from KKR - KKR-Tax Faq This is a pie chart showing Blackstone's income streams.  Prospect Capital is another fairly recent buy, more for the dividend that for stock price appreciation. Prospect is a BDC, and BDC's function in about the same manner as REIT's in that some 90% of any gains have to be returned to share holders. It's tough to find a good BDC of any appreciable Market Cap and this is the one I settled on.  Out of curiosity I searched around for a Business Development Company ETF and I shouldn't be surprised that I found one. BIZD was started in 2013 and have a look at those expenses and trading volume. This ETF's volume is comparable to that of a worthless penny stock and volume is important. Trying to sell shares of a stock or ETF that hardly trades at all at the price you want could be a real challenge, if the trade goes through at all. Here's the Rest of the Info for BIZD. It is educational. JC Penny - Double Down or ....What?  Boy, this stock certainly moved the wrong way, didn't it. I'm down about 50% so what to do, what to do.  Me, I think I'll double down at these prices and add in a kicker. A kicker for those unfamiliar with the gambling term, is when you have a poker hand with a pair - say two 7's. Instead of discarding three cards in hopes of picking up more 7's, you hold a face card in hopes of either getting two pair or a full house. And the kicker is..............  Martha Stewart! The reason for this depending on who you believe, is that MSO's bottom line is showing signs of improvement and they also recently signed a new contract with Penny's to sell some but all of MSO's merchandise. Considering the holiday season is just around the corner this could go swimmingly for both companies ........but there is that pesky lawsuit brought on by Sachs which seems to be only partially resolved. It's a cheap gamble and a speculation but stranger things have happened - the action in Western Lithium for example. And.......consider the entertainment value!  Kinda looking like the push-back is gaining some traction. |