Personal

Portfolio

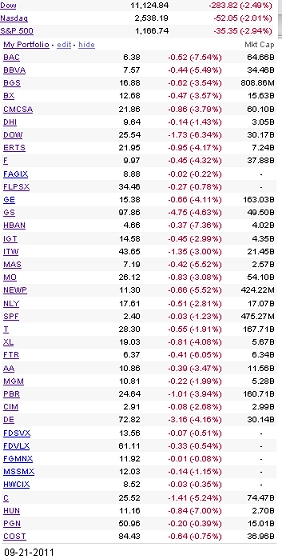

Dividend payers are still leading the way. About 33% of

the portfolio is focused on dividend yielding stocks. Treasury

bill rates are so low that people are being forced into higher yielding

paper - junk bonds, stocks and so on. Might be an idea to pick up

cheap stocks yielding safe dividends. You might get some growth and income.

|

Well looky here! Barry's got a new bill!

I've

got a job for Barry - lets see if he can keep his big job killing mouth

shut until the next election - giving the markets , banks,

big and small business some much needed breathing room. If

he can't keep it shut, perhaps Michelle can keep it crammed to capacity

with celery stalks, peas and carrot sticks.

|

|

09-21 - A Red Letter Day for Barry's administration.

Personal Portfolio

Back into Huntsman (HUN)

Last year Huntsman bought me a new fence,

dramatically increased the value of my 401K and the

investment account.

This year Huntsman got creamed

because they missed earnings by one penny. It was quite the sight

to behold. Even Jon Huntsman was amazed and ended up buying a

bunch of shares. Last quarter was the second best in Huntsman's

earnings history.

I ended up taking a 4% position in Huntsman again with a cost basis in the low 12's.

If

you are interested in some growth with a little income, I'd

consider Huntsman. It has improved its balance sheet and its PE

has been brought back to earth.

Spousal Education 101

How

many times have you heard horror stories about people whose spouses

died, where the spouse who died managed the finances and

the spouses left behind got raked over the coals by unscrupulous

predators in the financial world because they relied on their

partners to take care of the money.

It's not much different in

this household either but we are currently working on rectifying that

by setting up an investment account whereby the spousal newbie investor

to the investment world is in charge of managing a real account with

real money. The new investor has an additional incentive to learn

the basics because it's her money.

The first basic question is, 'What do you want to invest for.....Speculation?, Income?, Growth?, Value?, a combination?'

The answer in this case was 75% moderate growth with dividends reinvested in more shares, and 25% speculation.

The question next becomes, 'What companies do you want to invest in, and what criteria are you going to use?'

I

suggested looking first at companies that were familiar, had a

decent balance sheet, reasonable PE and got

creamed because the teleprompter once again flapped its jaws. These would be considered Value investment picks.

And these are what my wife ended up with:

Costco Wholesale at $76.67

Reason:

She likes Costco. Costco is also expanding overseas.

Its PE is reasonable, it has a low beta and it does pay a

small dividend. I'd call this a slow growth company with a stable

outlook.

Progress Energy at $45.61

Reason:

I am familiar with the company and they are expanding. It

has a very low beta and pays out a very decent dividend.

Make this a company where one in this environment would expect

growth and income.

Huntsman Corporation at $11.71

Reason:

Huntsman has always treated me well and their bottom line has

been continually improving. Being able to buy this stock at near

its 52 weeks lows is a gift, in my opinion. Decent yield at

these prices too. With a beta of 2, it will move - and hopefully

to the upside. This has the possibility of significant share

price appreciation and is a bit more speculative.

MGM Resorts at $12.52

Reason:

Frequently overlooked are companies in your own backyard.

We have been to MGM many times and like the resort. An

additional selling point for me was a TV edition of 'Underecover CEO',

which featured the new company CEO. The company has significant

business ties overseas which is helpipng fuel the bottom line.

This is to add some juice to the portfolio so I'll call this

specualtive growth with a beta guaranteed to take you on a roller

coaster ride.

My only regret is that I could have got it cheaper but 12 and change is not bad.

A Trading Strategy that Sometimes Works in Markets like what we've been seeing:

This has worked for me before and hopefully it will work again.

1.

Own one stock that does well in periods of volatility - holds its

value well and has a low beta. The stock in this case is NLY, a

REIT.

2. Own

another stock that that has a high beta and really moves during

volatile periods. This stock is Huntsman, a chemicals

manufacturer.

I sold half my shares of NLY during the sell-off and during that time the stock was actually still in the green.

I bought Huntsman at 10.16, which was trending down almost 10%

My

hope is that by September 29 the market will recover and I will

have Huntsman sold for a good gain and bought back more shares of

NLY just prior to the dividend distribution date. REIT's

generally drop somewhat in share price when the market rallies so

odds are I'll be getting NLY at a lower price than what I sold it for. That would be a icing on the cake.

Odds of that happening……….. better than one might think.

09-22 - Another Red Letter Day for Barry's Administration

I hope the clowns that voted for this chucklehead the first time around are starting to finally get a clue.

Storm clouds are coming - an unusual summer squall centered around Minden / Gardnerville, Nevada.

|

|