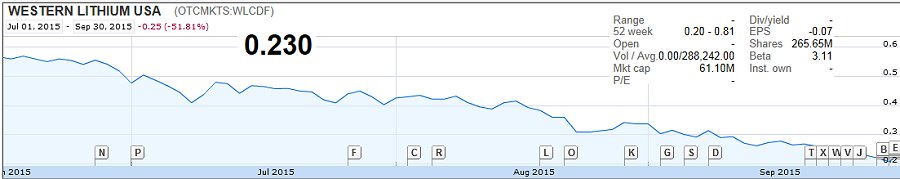

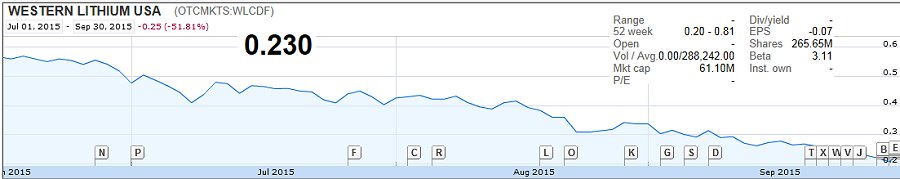

Western Lithium .........Need I say More?

This

month's chart reminds me of one long-term permabull in Western Lithium

who was proud of the fact that he bought in at .15 and continued buying

in over the years all the way up to a dollar and never sold a

share. It is looking to me like in the not too distant future,

that all his shares will be revisiting .15 again.

Doesn't make much sense to be 'long and strong and proud of it, when

one could perhaps done a lot of selling and locked in those gains and

perhaps make a few house payments with the proceeds, turning a 15

year loan into a 12 year one and paying off the house early.

I dunno......maybe it's just me.

GoPro (GPRO) - Not so Pleased at Present

Gopro's stock price too a big hit during this

correction and that is one of the hazards of new growth stocks and the

momentum that can follow them.

When a stock starts selling off, one has several options which are:

A: Sell and take a loss

B: Buy more shares on the way down, averaging down the cost.

C Hold.

I opted for option B and as of this date, all the shares I have are under water.

I think when the market rebounds, so will the stock price but it might take a while.

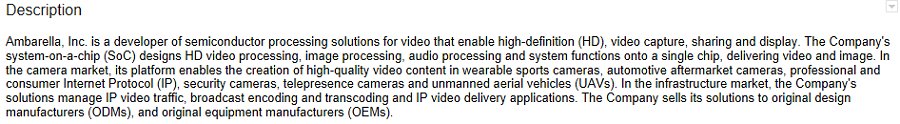

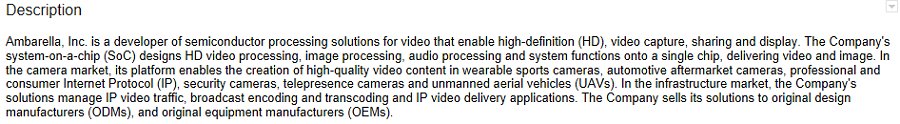

Related: Ambarella - AMBA

Ambarella among other

things, provides software to GoPro and its fortunes are tied to those

of GoPro so one does have to take that into account when having

positions in both stocks. At current trading prices, I think it

is worth taking a position in Ambarella.

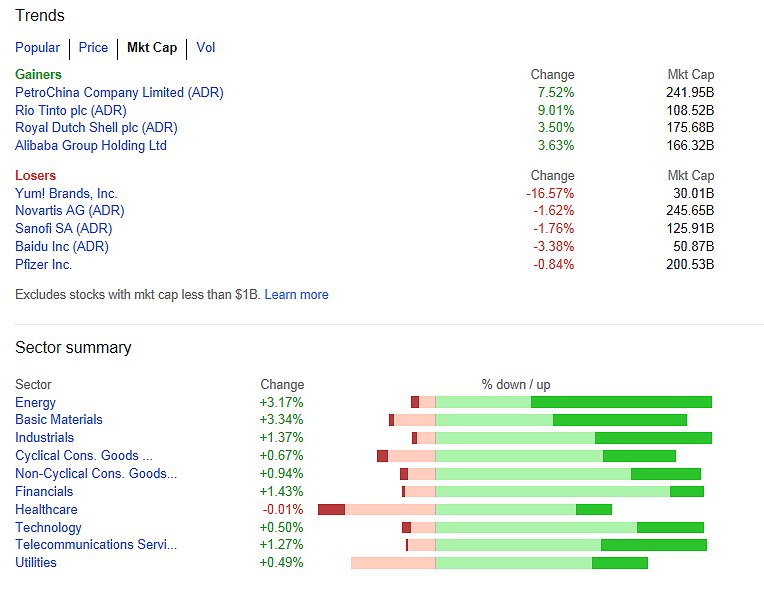

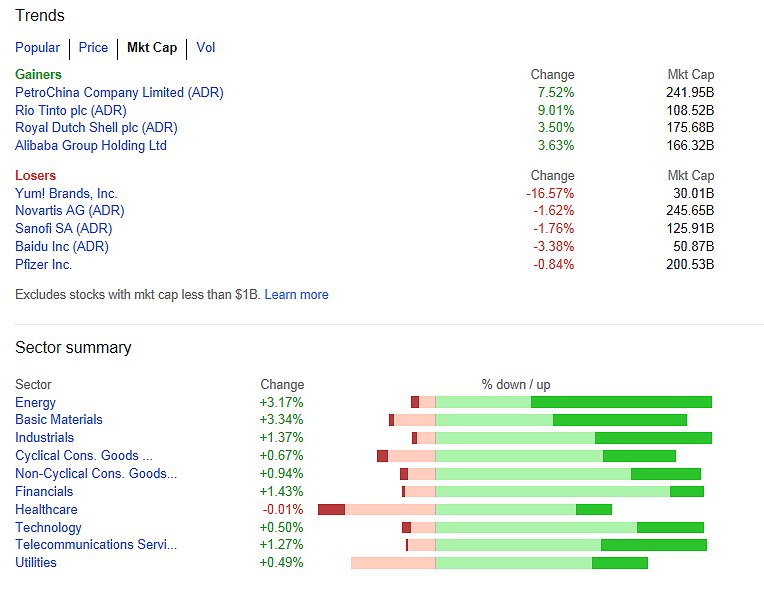

One of my favorite free sites for trading ideas:

Google Finance provides daily brief summaries of winners

and losers in four areas. Trolling through them early in the

trading session is a good way to find securities which might be worth a

short term trading opportunity. Specifically, I look for

stocks that got hammered for no good reason like missing estimates buy

a penny or two, or failing to give stellar forward earnings

guidance.

I've seen good companies lose 10+ percent of their value at the start

of a trading session over petty items. If I see something I like

that got walloped in early trading, I watch the ticker until I start

seeing a turnaround and then I try to scoop up some shares, hold

for a few days (sometimes longer) and then sell them back.

I'd say that works well about 70% of the time. Sometimes it works

not so well. Not worth betting the farm on a method like this,

but it is a way to make a few extra $$.

Current Allocation:

| Banks |

8.15% |

| Biotech |

.99% |

| Cash |

.1% |

| Investing Co's |

0.2% |

| Telecom |

11.07% |

| Manufacturing |

18.6% |

| Insurance |

4.17% |

| Raw Mtrls/ Chem |

5.99% |

| Retail |

2.77% |

| Tech |

12.82% |

| Food/Drugs / Sin |

15.35% |

| MF - G&I |

5.55% |

| MF - Value |

4.09% |

| MF - Small Cap |

3.57% |

| MF-Large Cap |

5.37% |

| MF-Sector |

2.29% |

It's always a good idea to do a periodic review of what you are holding where and see if the allocation makes sense.

I'm good with this mix.....it is assuming of course the economy at some

point does more than just stumble along and that is the reason for a

heavier weighting in manufacturing. Food and drugs - everyone

needs them. Tech and Telecom - I think that a substantial

weighting in these sectors goes without saying.

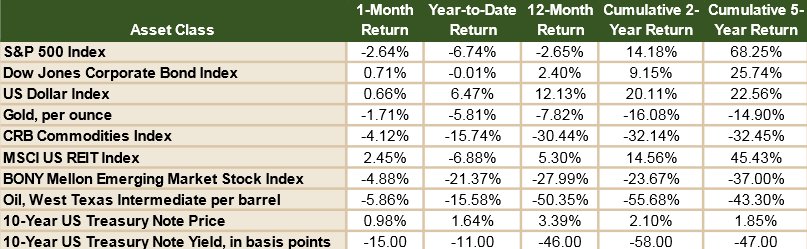

And last but not least, the Capitalist Pigs latest Monthly Newsletter.

All that glitters is not gold, silver or commodities, or REIT's.

One thing......don't pay attention to the charts if they are

confusing (I am not a chartist so sometimes they are).

Ignore the charts and read the text, which makes a lot more sense to me

than the charts often do.

The New Dog

|