The Professional Opinion

-A Super Special E-Alert during this market correction.

| August - September, 2015 “If you can’t get rich dealing with politicians, there’s something wrong with you.” Donald Trump |

|

The Professional Opinion  -A Super Special E-Alert during this market correction. |

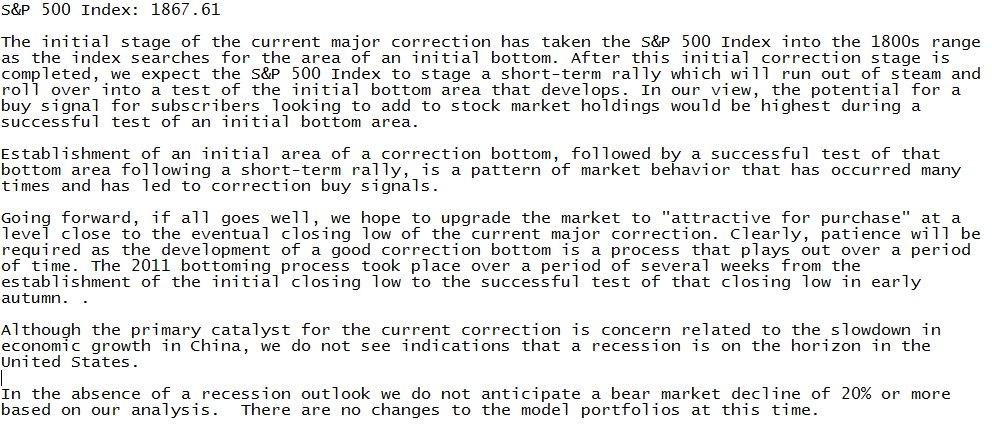

This month's winners are XL, PETS and MDR. Funny how that works out some time. Ended up adding more PETS,T, CBI and GPRO during the big drop. PETS and CBI are working out very well! |

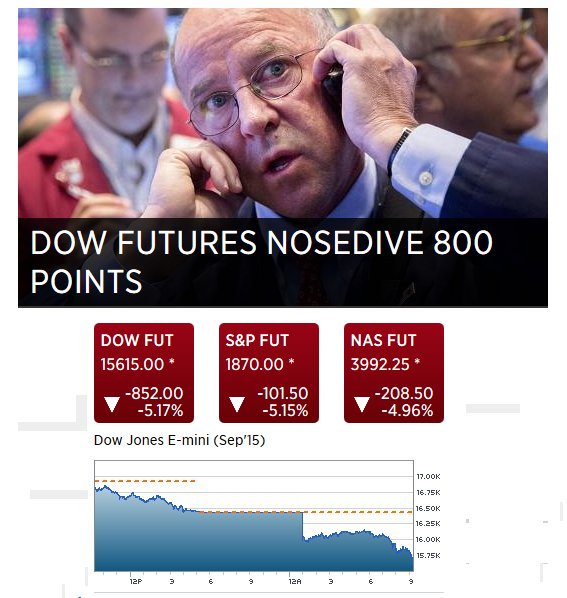

Well, it looks like the long awaited correction has finally arrived. The portfolio is actually still ahead for the year...barely. The only major thing I did was take the BDC's to cash and used them to buy shares of more of my favorites after the big plunge. So far that is working out well enough. A big price drop does not necessarily mean that one should do anything at all, especially if it is the result of a long needed correction, especially if one is new to the market and has not see a correction before.  |

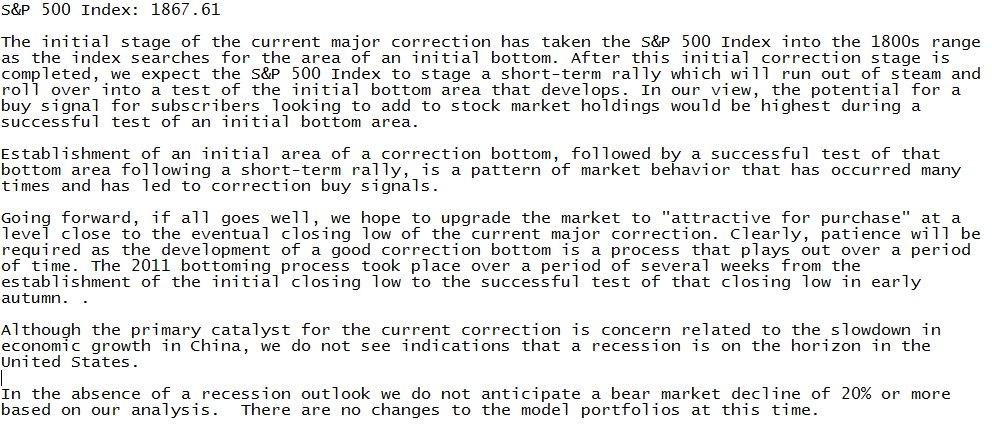

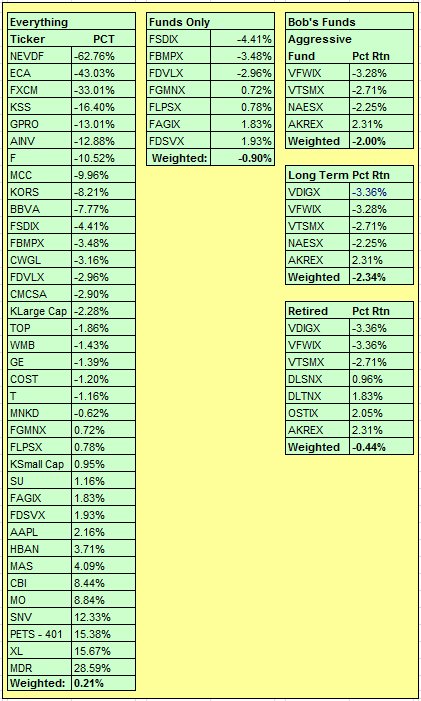

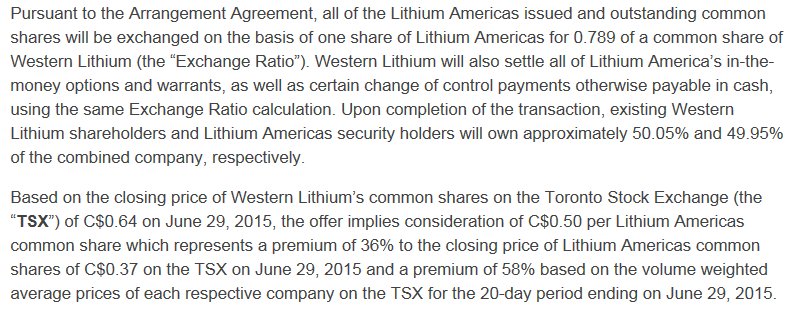

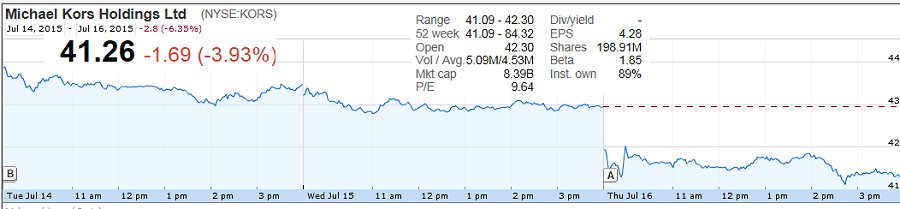

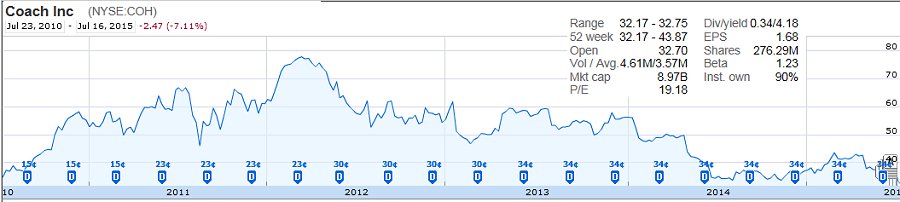

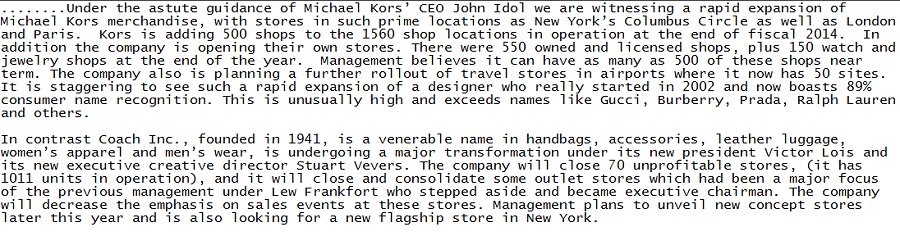

The Big Drop  Gee, we are finally having a long overdue correction and look at all the creatures crawling out of the woodwork..... Obnoxious radio ads have doubled up recently dealing with everything from fixed index annuities guaranteed never to lose your money and those incredible 8% up front bonuses..... Harry Dent who has been forever forecasting Dow 3000, has resurfaced with dire predictions of everything going to hell in a hand basket, recommending going to cash and maybe having a sack of silver coins to barter with when dollars become worthless. Of course Ads for 30% returns if you invest in oil wells! Really? In this climate? Then there are adds for buying gold and silver, and a bunch for silver only. Why you can turn your IRA into something solid! Like Gold and Silver coins at what kind of mark up? Wow......what a sterling investment. Let's not forget Real Estate. Now you can buy property with your IRA! Incredible Opportunity! What else...how about ads hawking Municipal Bonds 'tax free', never mind that these are all on the secondary market and how much extra that would cost.......... --------------- So if you are all into stocks, the markets is cratering and you see some incredible deals on stocks you wish you would have bought at these crashing prices, what can you do? Here's one of my favorites, assuming you have a diversified portfolio: Stock A is a reliable dividend producing stock with a low Beta (volatility) Stock B is all about growth - no dividends, high beta. Let's say the market crashes a 1000 points or so. Stock A is down 5%. Stock B is down 15%. Sell Stock A and buy Stock B. Later, assuming Stock A moves back up 5% and Stock B moves back up 15%, sell enough Stock A, to buy back the original position in Stock B + half the gains made from the sale. Keep the rest in Stock A, or invest it in something else. This doesn't work all the time of course, but it does work often enough to consider as an option where there is lots of volatility in the market. ------------------ Personal opinion: This correction is not worth losing sleep over. Western Lithium - Organoclay.....Not..Lithium.....Not....An Investor in the Stock......Not    Boy it sure makes sense to me for one non-producing developmental stage company to merger with another one that doesn't produce anything either. In fact it makes so much sense that a continued investment in this jewel of a penny stock is definitely above my pay grade. I'm out. Still have some Nevada Copper though. Michael Kors (KORS) - Fashion at a Discount....Maybe.........   Michael Kors got a severe haircut last quarter when earnings missed, and that brought the price multiples down into what I thought was an attractive range. I bought in at 43 and 47, about half and half. I don't know much about fashion except that like a Cairn Terrier, it is the very definition of 'fickle'. Going into higher end stores, one often sees Coach and Michael Kors in the same area. Coach.....I think has a branding problem and the stock price reflects that:  When I see the dividend going up and the stock price going down, that sets off warning bells.  Both companies share the same space and are about the same size. From a valuation perspective, Kors is the better bargain. Personally, looking the products overall, I like Coach better. Here's a snippet which I think reflects popular opinion when comparing the two:  I personally will stick with Kors and hope for a good quarter this time around. GoPro (GPRO) - Pleased so Far......and a Buying Opportunity!  If you are looking for a reasonable PE multiple, now would be a good time to have a look at some more GoPro stock. I've been picking up more shares here and there during this correction and am now a bit overweight the position. However, I think there is some money to be made here once the market bottoms. Picked a a Hero 2 on the cheap the other day, along with an LCD back so that should be fun to play with - wire the poodle up for Video!  This looks like fun! Current Allocation:

It's always a good idea to do a periodic review of what you are holding where and see if the allocation makes sense. I'm good with this mix.....it is assuming of course the teleprompter doesn't tax us into a recession. And last but not least, the Capitalist Pigs latest Monthly Newsletter. All that glitters is not gold, silver or commodities, or REIT's. One thing......don't pay attention to the charts if they are confusing (I am not a chartist so sometimes they are). Ignore the charts and read the text, which makes a lot more sense to me than the charts often do.  |