Personal

Portfolio

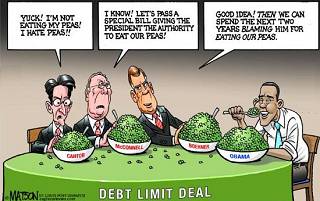

July could have been a decent month but it wasn't.

Another great reason for registering to vote.

|

It

would take a government full of pea-brained idiots not to raise

the debt ceiling. It is something that has to be done because

like it or not, we are a debtor nation.

Defaulting on debt is not an acceptable way of making a political statement. ........

Voting the rest of these fools out of office......is.

|

|

Personal Portfolio

Debt Ceiling Commentary

My

view on the debt ceiling is that it will be raised – it has to be

raised. I think that what we are seeing is pure political

posturing to the detriment of the country. We will have a

congress and senate and presidential office of fools if we don’t (not

saying we don’t have for the most part anyway).

The

thing that amazes me is that some of the tea party crowd think letting

the country go into default is the only way to fix the country.

What

complete idiots! If any of these tea party candidates are

considering running for the highest office, they should be sent packing

before they make it out of the gate.

When we issue bonds, we are

issuing sovereign debt. A large portion of that sovereign debt is

held by foreign governments who in effect, become our bankers.

They are relying on the good faith and credit of the United States to

make good on interest payments and return of capital. The

last thing you would want to do is to default on your creditors.

If you want to plunge the US into a deeper recession and ensure the recovery takes forever, default on US debt.

The way I am playing this is basically to do nothing. I think the government is not that stupid. It can’t be.

Assuming

this gets resolved, I think gold and other ‘flight to quality’

commodities etc will fall and I think market will continue rebounding

if the government quits dicking around with banks and big

business, as well as small have some sort of well defined direction.

I think interest rates will continue staying low if the govt gets its act together on debt ceiling legislation.

If

they are actually stupid enough to allow the country to default,

creditors are going to want higher interest rates on bond issues

because the trust factor just got reduced.If that happens, I

would probably bail out of REITs.

The interest rate

effect will snowball, making it more costly for everyone to borrow

money. At that point I’d be looking at banks and blue chips.

Annaly

came out with their economic report for the second quarter. I

don't pretend to understand all of it (not many people do) but the

general flavor I get is that if you are in REIT business and know how

to play the spreads, you can do ok. The rest of the economy

didn't do that well.

Here is Annaly's Report.

I had a thought along these lines regarding REIT's:

There

are millions of mortgages under water, people upside down on

their mortgages who can't refinance because home values are less than

the mortgages they are currently holding. This means to me that

refinancing is going to be quite difficult for many, which means that

many people have no option other than to pay what now would be

considered to be an abnormally high interest payment.

Either

that, or walk away from the home. Home prices will recover over

time, but I expect it's going to take a long time.

Therefore if you own REIT's that can navigate these market conditions, I think you could do ok.

Voluntary disclosure: Long on NLY and speculative on CIM

Yearly Checkup

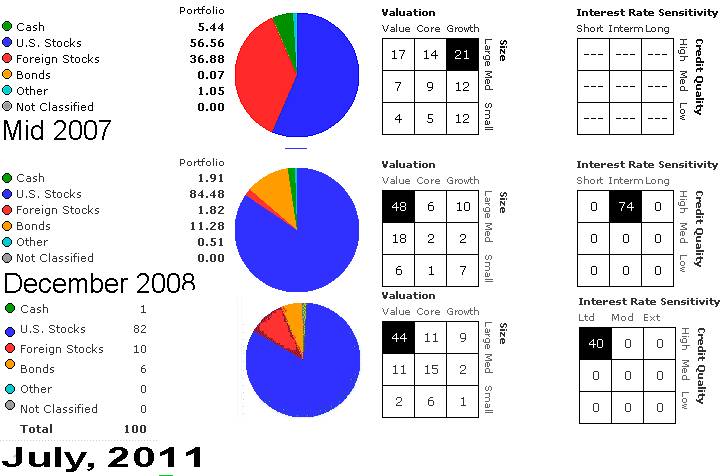

Morningstar's Instant X-Ray is a good way to get a breakdown of what you really own.

I'm heavy on cyclicals and that's ok with me. Not much speculative growth, which is ok too.

I think this will work out well for the forseeable future.

What Else.......

Here's the portfolio allocations:

| Sector |

Apr |

May |

June | July |

| Banks: |

18.98% |

17.97% |

17.02% | 16.21% |

| Investing Co's |

2.71% |

2.73% |

2.78% | 2.88% |

| Telecom / Inet |

12.37% |

12.36% |

10.22% | 12.3% |

| Manufacturing |

12.61% |

12.78% |

12.15% | 13.78% |

| Food / Sin |

10.31% |

8.42% |

9.01% | 9.06% |

| Insurance |

6.10% |

5.92% |

5.91% | 5.41% |

| Raw Materials | - | - | - | |

| Real Estate |

5.42% |

5.44% |

7.36% | 7.08% |

| Tech |

4.60% |

7.24% |

4.97% | 3.03% |

| MF -

G&I |

7.23% |

7.15% |

7.36% | 7.76% |

| MF - Value |

7.18% |

7.56% |

6.68% | 6.77% |

| MF - Small Cap |

4.51% |

4.94% |

4.25% | 4.3% |

| MF - Large Cap |

4.36% |

4.38% |

4.49% | 4.63% |

| Other |

@ 4% |

@3% |

@7.4% | 5.5% |

Black Swallowtail butterfly - Konza Prairie near Manhattan, KS.

| |