Personal

Portfolio

|

It has been an interesting month.

Talk about a jobless recovery......

Earnings have been coming in better than expected for a while now. It started with Alcoa is continuing.

It's looking like we might actually have a month whereupon we close

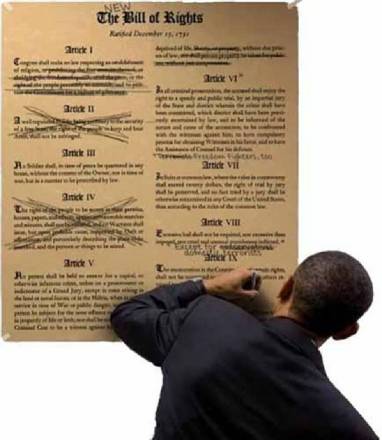

up - that is if the teleprompter can manage to keep its mouth shut for

three or four more days.

I'd be for keeping an eye on those

better-run regional banks. I continue to think there are

opportunities to be had with a bit of patience.

Masco (MAS), as

well as some of the home builders are getting quite attractive again.

Standard Pacific Homes (SPF) moves on good news and it is cheap.

Of course to make some serious change, one would have to make a

sizable investment and therein lies the risk. With a little

patience, the stock can be rewarding.

|

|

Personal Portfolio

July

has been shaping up nicely. I sold the rest of Huntsman in the

taxable account ahead of the planned tax hikes. That figured out

to a 342% profit - one of the best gains I've ever made. Might as

well keep as much of it as I can.

I decided to take some gains

to cash last week, planning on the teleprompter's monthly

trashing of some area of business and thus creating a temporary buying

opportunity. To my utter amazement, it hasn't happened - yet.

Perhaps the teleprompter had something a bit more destructive in mind.......

About those Regional Banks..

I

took the opportunity to start picking up some more shares of HBAN and

RF this month at what I think were depressed prices.

Emphasis

was on HBAN. I think people picking up shares on the dips could

end up being quite satisfied if they have a longer term perspective.

One

day later, Regions reported their earnings and while they did not

turn a profit, they lost less than what was expected.

I don't see much else out there worth looking at, at this point.

There is One Exception

In

the world according to me, I think in order for the economy to

recover, the financial sector has to recover first.

Commodities and materials suppliers will recover second.

Masco

supplies the likes of Home Depot and Lowes. They supply the

suppliers, especially in the area of home building materials.

Disappointing earnings tanked the stock today (looks like a buying

opportunity to me, so I did) and I think it is trading at very

attractive levels. This stock I regard as a core holding and I

have lots of it - all

dividends set for reinvesting in more shares of the stock.

I think it is going to pay to go over-weight on this stock in the short term :).

Financials Recover First and then.....Commodities?

PSPFX has made me a lot of money over the years and I have been eye balling it again lately.

When

I decided it is no longer prudent to be over weight in

financials, I will probably diversify out into this fund again.

It's not for the faint of heart and it is volatile but it can be worth the time and effort.

ADRE

is an ETF and it is more concentrated than PSPFX. I've done well

with this one too. It pays out a dividend as well.

Trading Software - Your Road to Riches?

In my view, the surest way to accumulate large sums of money is to

do so over time, deferring as much as possible in tax privileged

accounts.

In my view, the surest way to lose large sums of money

is to fall victim to on-line proprietary trading platforms with their

claims that your road to financial salvation is just around the

corner. All you have to do is trade using their software

and your troubles will be over. Heck, you can win free prizes too!

These programs are not about

saving and investing. They are about trading because that is how

the companies selling these trading services make their money.

While they may have their place for some, I would say with confidence

that 90% of the investing population should stay away from them, myself

included.

The reason for this? Pretty simple actually if your remember that:

A: It takes money to make money.

B: It takes a lot of money to make a lot of money.

These companies are counting on you the small investor, not to think this through.

Companies

like these cater to anyone and they make the bulk of their profits off

the small investor. It is also the small investor who ends up

losing the most in the end. They have some money to make money,

but they don't have a lot of money to make it truly worthwhile.

The primary reason for this is the fees and taxes generated from frequent trading and I will provide a simple example.

BallStreet's trading program indicates a rising trend in DavidsLiteDonuts, trading symbol DLD.

DLD is trading at $10.00 a share and you, the small investor have $1000.00 to spend.

The charts and candle sticks and everything else look quite pretty (that is the point, isn't it?).

It

costs $4.95 to make the trade so you end up investing $995.05 in DavidsLiteDonuts and are now the proud owner of 99.505 shares of same.

Now if only they go up in value.........

The

market is trending up and it is a decent day all in all and DLD is

moving with the market. DLD is a fairly volatile stock, thinly

traded and the candlesticks and colorful charting lines indicate an

exit point of $11.20, or a gain of 12%.

The program encourages you to take the profit so you put in a sell order of 99.505 shares at $11.20.

The trade goes through!

You made $111.44!

Oops, we forgot about the $4.95 it also costs to sell the stock.

111.44 -4.95 = $106.49 of Pure Profit!

But lets not forget that this is a Short Term Capital Gain and assume a 25% tax rate.

Uncle Sam wants a cut and that is going to cost $30.66.

What's left when all is said an done?

You have a gain of $78.84, or about 7.8%

Do you think that stock trading is something you should give up your day job for?

That's easy enough to figure out.

Let's say I take home $500.00 a week from my day job, which is $2000.00 a month. I'm doing ok, all in all.

I would need to make 25 trades a week using the above example where I was making 12% every trade.

For

each concurrent trade, I would need to have an additional $1000

invested. 5 concurrent trades = $5000.00 in capital.

In

the real world, do you think your favorite trading software is going to

help you get it right every single time, for gains of 12+ percent?

In the real world, that ain't gonna happen.

Every

time you lose on a trade, you have to make up for that loss on another

trade, which lends itself to riskier trades with more speculative

stocks. It is very easy to get sucked into a downward spiral.

In

the end if you are lucky, you won't have lost - much, and those that

encouraged you to use their platforms......well......those

watermelon smiles they are wearing got a bit wider.

A rare sight in July, in Northern Nevada

|

|