| July, 2013 “It’s here that companies like Solyndra are leading the way toward a brighter and more prosperous future.” ~ the teleprompter |

|

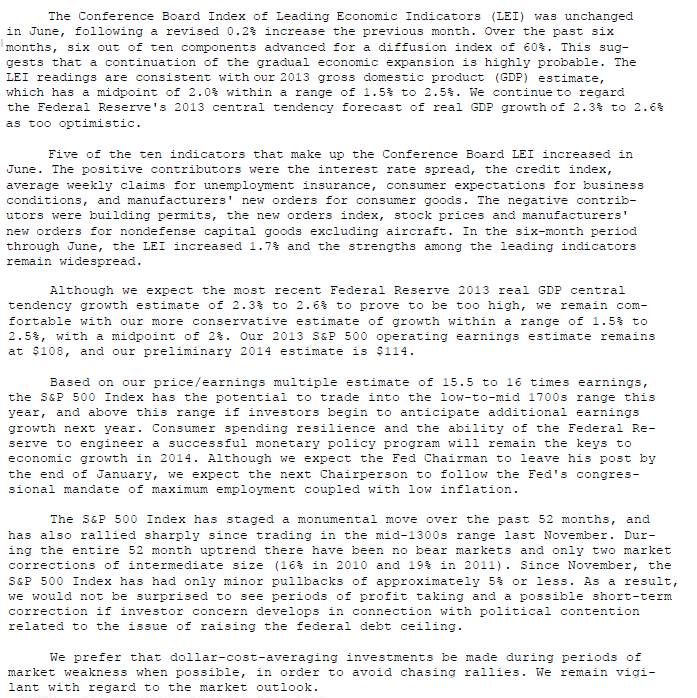

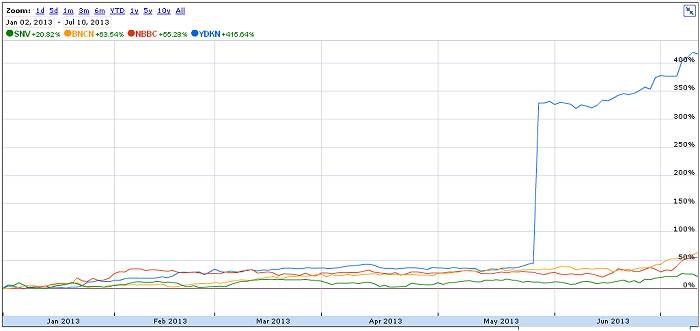

The Professional Opinion - DJ 1685.73  Buy Recommendations None. Everything is rated as a hold, as is usually the case. However, there is a sell recommendation - Bob doesn't like GNMA's anymore. He prefers something with a shorter duration, the Fidelity Floating Rate High Income Fund for example.  Container gardening has an unexpected setback. |

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. |

I was reading the other day that George Orwell's '1984' is getting quite popular on Amazon and small wonder considering the government's unwelcome intrusion into the lives of ordinary people for the betterment of.........what......exactly? Kind of makes one question how a couple islamic murderers got away with the Boston Marathon bombing, considering their prolific use of social media. I mean the NSA should have picked right up on that, shouldn't they have? In retrospect, no surprise there. After all, these are the same clowns that created the TSA - another fine entity that has not managed to do much more than aggravate travelers and fatten the wallets of attorneys.  |

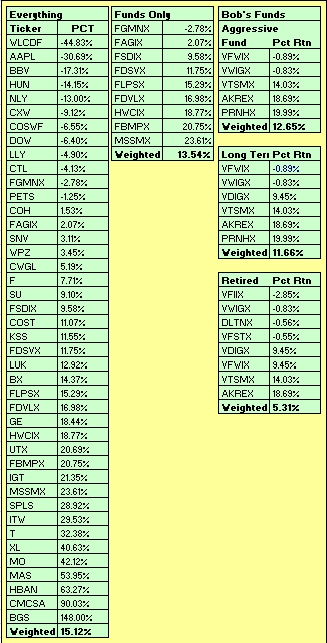

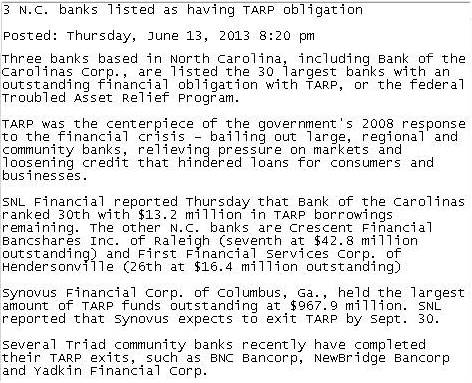

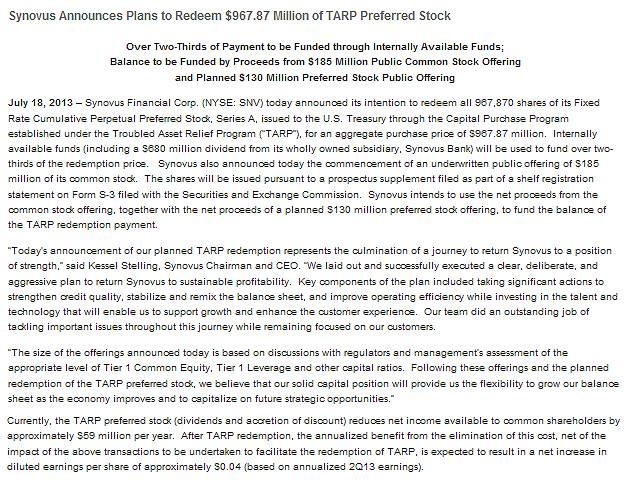

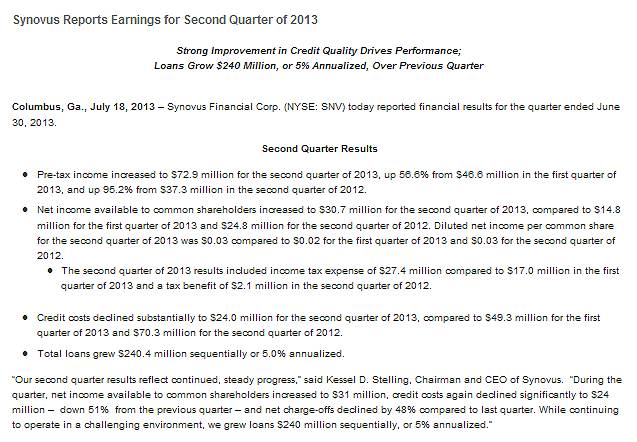

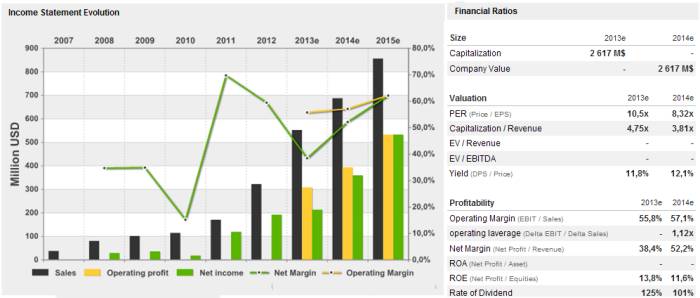

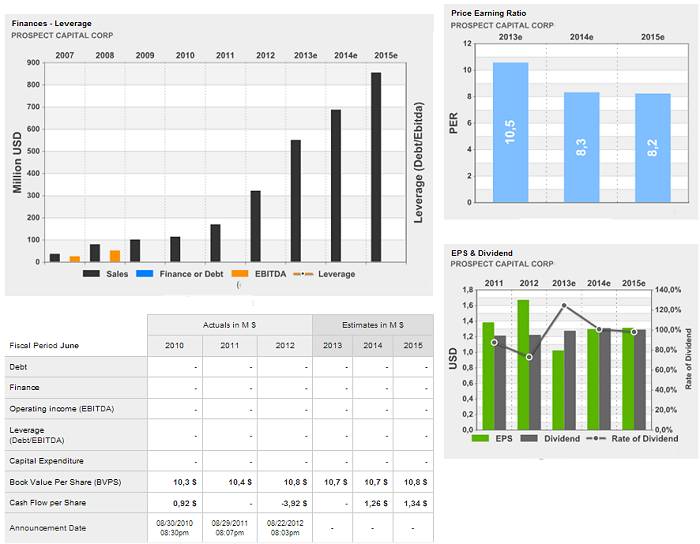

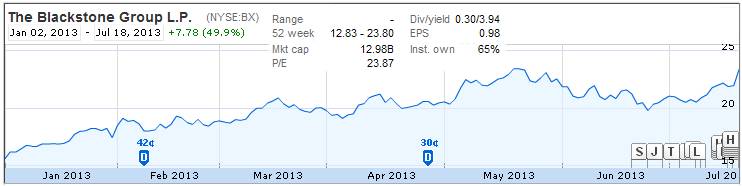

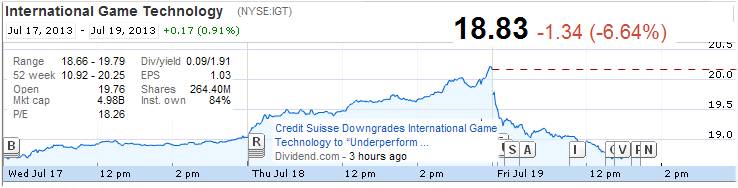

Bottom Fishing the Financials  Some months ago I speculated that Synovus Financial could make me a lot of money if it finally got its act together and repaid their TARP funds. To date they have not done that, but they have cleaned up their balance sheet and with that feat, have returned me around 20% to date. Not bad. I thought it might be worth looking at how three other community banks fared once they repaid tarp:    52 week returns for these three community banks have done very well indeed and their market capitalization is much smaller than that of Synovus. Returns for Synovus and the above three banks might look interesting all in one chart:  It seems reasonable to me that if Synovus pays off their TARP funds in September like they said they would, there could be a nice pop in the share price. That's less than three months away for all you home-gamers.  With a market cap about 10 times that of the other three banks, a very low PE and still paying the one penny dividend, how high might this go? Time to whip out my handy-dandy calculator. Let's say a PE of 10 is reasonable and the current share price is $3.00. Earnings are around 87 cents a share. PE = Price of the Stock divided by the Earnings per Share. A more normalized PE of 10 wooed indicate a stock price of about $8.75 - not bad. A PE of 15 would result in a price of about $13.10, or four times what one share of SNV is worth now. What did I do? I salted some of these shares into several accounts, taxable and non-taxable making the total investment about 3% of the portfolio. It's now worth about 4% of the portfolio. If SNV does not repay their TARP loan, interest rates on that loan go to something like 9% and I think that is a powerful incentive to make the repayment. Something to remember about $3.00 stocks - the potential downside is $3.00 a share. The potential upside......well.......in September I guess I'll find out. Update:    Not bad at all! This is looking very promising. To BDC or not to BDC...  I personally think there is a lot of upside to the financial services sector, particularly since key aspects of telepromptor-sponsored health care have been derailed for another year. If one is currently looking for yield and can some risk in share price, Business Development Companies or BDC's, are another way to do some diversification in the area of finance. BDC's provide capital to companies that wish to expand, update their facilities, make new acquisitions and so on. Companies of this sort typically have less than stellar credit ratings and those credit ratings are often in the BBB's - in other words, junk. BDC's fill the lending niche. BDC's are structured similarly to REIT's in that 95% of their earnings have to be distributed to share holders, and the yields can be substantial. Most BDC capitalization falls within the definition of a small or micro-cap company. There aren't many large ones. If I was interested in investing in a BDC, I would be looking for a large one in hopes of share price stability. I would also be looking for one that has paid regular and steadily increasing dividends. I would also be looking at yield - is the yield worth the risk. All that I did, and I came up with Prospect Capital Corporation (PCC). To BDC or not to BDC...  With a capitalization of over 2.5 billion dollars, Prospect Capital is one of the larger corporations. In my view, all the numbers are headed in the right direction.  I'd say PCC does a pretty good job of managing risk and volatility in share price. I decided to make a small investment. Here's a link to their Current Portfolio. Some of the companies will probably sound familiar. Here's a link to an analysis of their Bond Portfolio Credit Rating, relative strength and outlook. I've played around with smaller BDC's before because profit can be made with the volatility in share price. PCC looks like it is worth keeping for a while. What can you say about Blackstone.....   I finally had to sell some of this as the portfolio was getting way too overweighted in Blackstone. I still have a lot of it though and think it will continue to improve. What to do with the Proceeds......  It just so happened the IGT got hit with a downgrade, which I don't think was justified. I guess we'll find out when IGT reports at the end of the month. Who's the better Stock Picker - a Monkey, a Blind Man or an Analyst? Back in the 80's an interesting article came out in which it was hypothesized that a monkey throwing darts at the stock pages of the New York times would likely do just as well as a stock analyst when it came to picking stocks for a portfolio. The hypothesis was put to the test and it was done with several analysts. The same monkey was used for all portfolios because I would imagine there is an extremely finite number of monkeys possessing the ability to throw darts. As I remember, there were four or five test portfolios and in the end, the monkey came out marginally ahead. It did not say much for financial analysis. Thirty years later I decided to revisit the test. I constructed two fantasy portfolios. These portfolios were both worth 100K and that 100K was divided equally among ten stocks. For the first portfolio and lacking a monkey, I closed my eyes and keyed random letters until I came up with a stock ticker, and then added that to portfolio #1. For the second, I cherry-picked my personal portfolio for what I thought were the 10 best stocks, or stocks with the most potential. After one month, here are the results.....  which so far are kinda disheartening.

Boy that worked out really well, didn't it. Another Opinion about the PITA that is thoroughly documented and well worth reading if you in a moment of weakness, consider taking this PITA's advice:  Snippet from 'A Modern Quest' , a site dedicated to The PITA Problem: Scams, Shams, and Shenanigans  Couldn't pass this up - Funniest thing I've seen and heard in months - news reporting and vetting at its finest. |