The Professional Opinion

I'm thinking it might be a space saver just to insert 'Stay fully Invested and Buy on the Dips' in place of an image.

| June, 2016 "I wasn't satisfied just to earn a good living. I was looking to make a statement. " ~ Donald Trump |

|

The Professional Opinion  I'm thinking it might be a space saver just to insert 'Stay fully Invested and Buy on the Dips' in place of an image. |

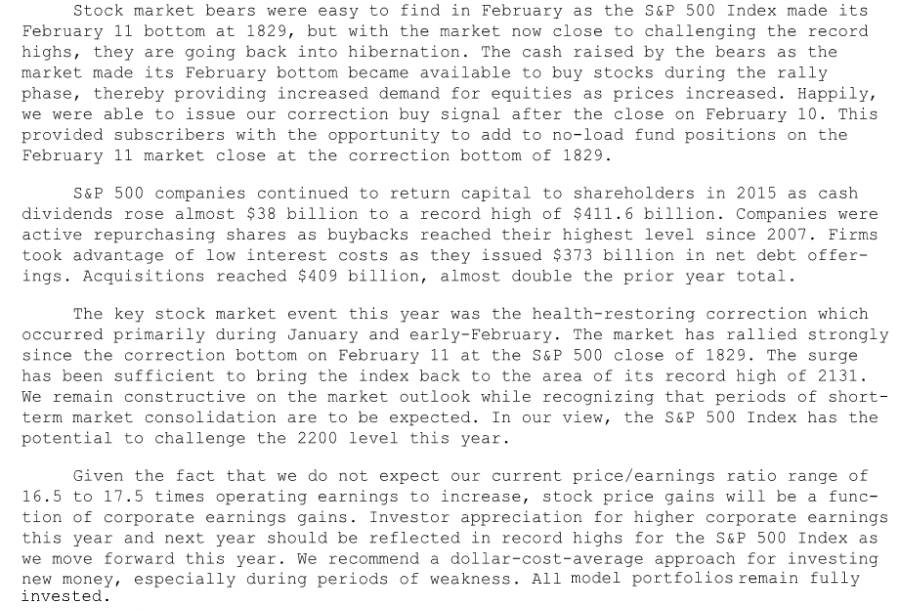

6.4%......not that bad so far, but the year is still young and it is looking like the large caps are leading the pack. Walmart is a great example of bottom-fishing after a company gets knee-capped after a less than stellar earnings Report. |

It is interesting watching the teleprompter go through all manner of contortions in its efforts to avoid calling islamic murderers - islamic murderers. I always thought one of the primary duties of a Commander in Chief was to protect the citizenry and I think this commander tends to forget that the citizenry of the U.S. does in fact live in the U.S. and not in the Middle East. The year so far has not been one for extraordinary gains. Poor economic growth, poor GDP, record numbers not working.....another big increase in Obamacare rates...it's a wonder we are moving forward at all. It has been a decent year for those who like to do a little trading.....VIX has been quite the help meet.  |

|

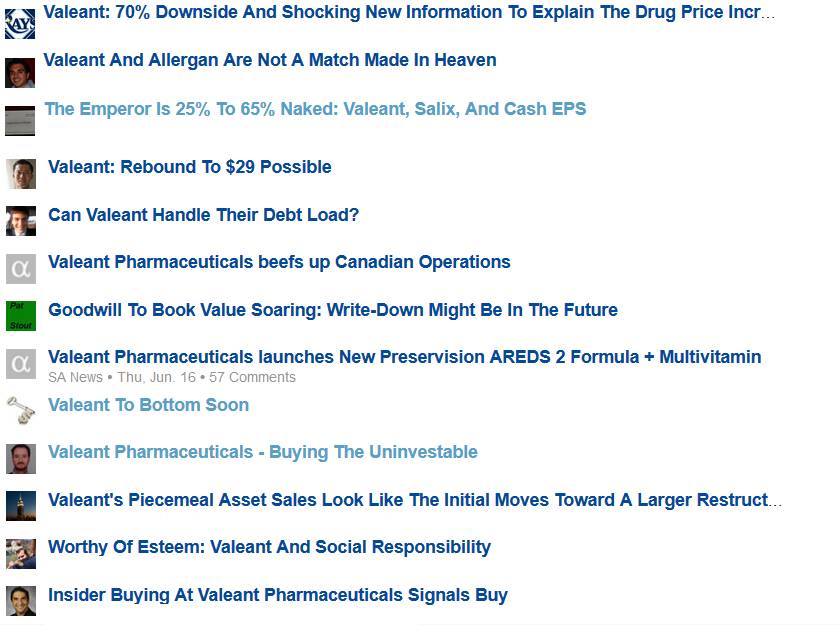

Western Lithium .........Western What?   So what does a penny stock do when it hasn't developed much of anything at all, is still stuck in a research lab and is is running out of money? Why it merges with another developmental stage company and changes its name! The joys of penny stock ownership.  If you got in on the low end, you would have done quite well. If that person was me, I would have taken the money and ran. I may keep tabs on this one for a while........must be a masochistic streak or something. And of Course the 900 Pound Parakeet in the Room....BREXIT  The BREXIT vote coming in a few days is I think an opportunity to make a little money.  Not that I really care, although I think I would be voting to leave the EU if I was a Brit and I had the chance. British pollsters are notorious for getting polling wrong and the polling at present indicates that Britain is going to vote to stay in the EU. I think they might be wrong about that. People lie to pollsters all the time and while politically correct words may be coming out of their mouths, the actual vote may just be something else. I don't see much of a downside to them leaving the EU, other than guaranteed volatility in the financial markets. If the possibility of Greece doing a GREXIT could produce the kind of volatility it did, and Greece producing only 1-2% of the world GDP, imagine what a BREXIT would be like.  I think this is an opportunity so I went @ 10% cash today, selling some of the mediocre and poor-performing equities. If BREXIT happens, I think there will be some wonderful opportunities to go bottom-fishing shortly thereafter. If not, I'm sure another crisis will come along where those monies can be reinvested at better prices. Kind of ironic in wasn't it a Commie-Lib who said 'Never let a good crisis go to waste?' A Long Term Speculation - VRX  Boy, is that quite the fall from grace. So what does VRX do?  So what the heck happened? Let's see........ 1. The company got caught up in the drug price-gouging scandal. 2. The CEO ended up resigning and before doing so, had to do the obligatory perp-walk in front of congress. 3. One of the companies owned by VRX had some accounting issues, delaying the filing of the quarterly 10K I would say those were the three big ones primarily responsible for driving the price into the toilet. What do others think of VRX in terms of a little speculation?  Opinions are all over the map. Me, I personally think that the company is a screaming buy, especially if held for the long term - six months minimum and preferably longer. I already did very well when the media was awash with reports of bankruptcy and other absurd opinions. Gee, the company did not go bankrupt and the company did get a new CEO, and a well respected one at that. Today my cost basis ranges from 23-32, with most of those shares purchased at the lower range. This one is for speculation only although I am reminded of an oft repeated quote for these times and circumstances: 'This too, shall pass.' Allocation:

The change from December to June was more selling some assets to raise cash in the event the BREXIT vote goes in the affirmative. If that happens, it will be nice to have some money to play with. And last but not least, June's Capitalist Pigs latest Monthly Newsletter. This newsletter was more bearish than most, and it reflects the opinions on the Saturday weekly show.  It's about time............... |