June 2007 Market Timing Update

""Diversification is a protection against ignorance. It makes little sense for those who know what they're doing."

June 2007

Market Timing Update

""Diversification

is a protection against ignorance. It makes little sense for those who

know what they're doing."

- Warren Buffet

The

Cyclical Bull Market

Bob is of the opinion that there is no Bear Market in the near future.

A Bear Market is viewed as a market

decline of over 20%.

This month he sets forth his reasons for believing the market is going to reach new highs going forward.

Recession Risk

There is a very low chance of

recession with the real GDP as anemic as it is. Bob estimates

the GDP for 2007 in

the range of 2-2.8%. That is pretty anemic. No

unrestrained growth here.

People are still adjusting their spending to accommodate for high gasoline prices. No out of control spending in sight.

Overseas however, US companies are enjoying robust sales.

Housing

troubles are likely to persist through 2007. The median price

for

a home is now 212,000,

the lowest since the first quarter of 2005.

Inflation risk - there isn't any. It is being restrained by very slow domestic growth.

Energy - "Although an active

hurricane season could push energy prices higher in the months ahead,

this would have

the effect of restraining economic growth prospects as consumers would

be forced to reallocate additional

discretionary spending dollars into their energy budgets. In

our view, higher energy prices serve to constrain

economic growth, and thereby have a de facto counter-inflationary

impact

on the overall price trend."

Inflation and Valuation -

The S&P 500 index is currently 17.6 and Bob is

comfortable with a range of 16-17.

Inflation is only apparent to inflation gremlins trying to find it.

The Secular Bear Market Trend

Somehow I missed this one.

Bob believes the secular Bear Market we have been in since

2000 is

over.

Bob expects to see significant gains going forward. This is a

big deal. Money is out there to be made.

The 60 day Put-Call Ratio

This contrary indicator remains solidly in bullish territory, with a reading of .997.

There is lots of skepticism out

there and the level of short interest is very high.

Bob expects to see significant gains going forward.

In summary, the Market Timing model is solidly bullish and corrections will be minor.

"The Market Timer Stock Market timing model remains in positive territory, and we expect to seePortfolio Changes

No portfolio changes. All stocks are still rated hold.

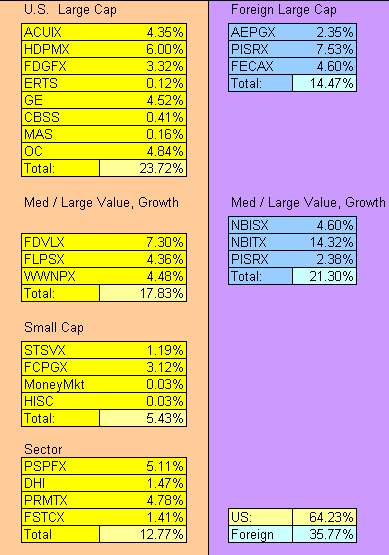

Personal Portfolio

I decided to lighten up a bit

more on international

exposure buy reducing holdings in NBITX and shifting that to

the Hodges fund (HDPMX). NBITX has very little

exposure to energy, commodities and transportation. Hodges

does. Hodges has a higher expense ratio than NBITX and is also doing

about 4% better than NBITX.

Hodges fund is run by John

Hodges out of Texas. It is one of those funds that don't

quite fit into a Morningstar

category. It can be best described as an All-Cap fund.

The fund is not for

everyone, with a Beta of 1.72 and should things go south -

one of the first to liquidate. If the

market is to continue on to new highs through 2007,

this fund could perform quite admirably.

Anyway, this is the latest breakdown.

Well,well. I actually had a request for a topic suitable for lunch time rumination.

I thought I could knock

this out during one lunch hour but after thinking about it a bit,

this looks like at least two lunches.

Establishing an Asset Base

In Tax Deferred Accounts

The best way to establish

an asset base is through a tax deferred account. 401K's, SEP-IRA's,

403B's are

examples of tax deferred accounts. Picking good, low cost mutual funds

for your initial investments is a good

way to start.

Choose funds representing

several broad areas. Large Cap, Small Cap and International

funds give an account

broad exposure and lots of diversification.

Funds which throw off lots of capital gains at the end of the year are perfect for deferred accounts.

One of the ideas behind tax

deferred accounts is to maximize your returns. It makes little sense to

choose money

market and bond funds as an investment of choice in a deferred account.

In Taxable Accounts

Choosing the appropriate

funds for taxable accounts is a big deal. Anyone who listened

to the news up to and

after April 15, 2007 more than likely heard some of the horror stories

about people getting hammered with

capital gains taxes to the tune of thousands of

dollars.

I learned my lesson in

2001. Paying massive capital gains taxes is not

cool. In those days I did not pay much

attention to where I held my tax friendly and tax hell funds. As a

result I got walloped with short term capital

gains taxes.

I

owned some funds that did close to 200% turnover and were in taxable

accounts. You only need to go

through an experience like that once to see the wisdom in properly

allocating funds.

Choose tax friendly funds

for taxable accounts. A Google search on the term provides

lots of sources for tax

friendly funds.

Index, Long Term Growth and Growth and Income funds are examples of tax

friendly funds.

A few that come to mind are UMBIX, VFINX, FBRVX, JAENX, DODFX, AMANX and of course the index funds.

DRIP Accounts

DRIP's, aka Dividend

Reinvestment Plans are a good way to begin purchase (notice I said

purchase, not trading)

of individual stocks and the first step in further reducing the overall

cost for managing your portfolio.

In a DRIP plan, you make

monthly purchases of a stock and the stock's dividends are reinvested

in new shares of

stock. The only thing you pay is a fee for buying shares and

taxes on the dividends (currently 15%).

Expenses are an important point here.

Lets say you start a DRIP

plan with GE (General Electric). GE is a good stock to start

with because the company

itself is about as diversified as a mutual fund. A drag on the

financial or health sector for example is not going to

cream the stock.

The minimum investment per

month is about $20.00. The plan charges $1.00 for each investment.

That's it - $1.00.

Now lets say you invested

$100.00 a month for 12 months. Total Cost to you is $12.00 and

dividends are

reinvested for free.

Assume the shares around

$30.00 apiece, and that is 40 shares of GE.

Reinvested dividends are around $20.00.

Taxes on dividends are $3.00

Total cost is about $15.00

Pick an average mutual fund

and run the numbers using the SEC's handy dandy cost calculator

http://www.sec.gov/investor/tools/mfcc/mfcc-intsec.htm

and the cost is about $21.00

A DRIP plan in this example

costs 33% less in terms of fees and expenses than one of the better

performing

mutual funds.

Start tacking some zeros on to these examples and the difference is dramatic.

Some companies offering DRIP Plans:

CAG, GE, AT,ITW, HD, XOM, JNJ, MAS, BAC

Recap:

During the early

Accumulation of Assets phase, adequate diversification is the key.

Adequate diversification is

accomplished by the right kinds of mutual funds in the right types of

accounts - tax friendly for taxable and high

octane for tax deferred.

Direct stock ownership

should be limited to DRIP or like accounts and regarded as a long term

hold,

not as a trading vehicle.

Now that you have a few $$$........

One of the biggest

drawbacks to individual stocks is lack of diversification.

One of the biggest drawbacks to mutual funds is management cost.

What is the right balance?

Somewhere in the middle, I think.

Some professionals say a portfolio of 25 quality stocks broadly diversified throughout the market is optimal.

No more than 4% in one individual stock helps assure proper diversification.

Some professionals consider direct stock ownership in any percentage as entirely too risky.

My own personal comfort

level is currently about 90% in mutual funds and 10% in stock with no

more than about

4-5% in any one stock. Half of the stock is invested for the

long term in Drip plans, in taxable accounts. The other

half is invested in a deferred account for growth.

While I would not be

comfortable owning only 25 stocks and I think there are ways to reduce

portfolio costs -

by owning stocks.

ETF's (Exchange Traded Funds) should be mentioned as well.

An exchange traded fund is

a basket of stocks which trades like a stock. Fees associated

with ETF's are

generally pretty low. The thing about ETF's is know what you are buying.

ETF's come in many flavors.

ETF's are indexes of just about anything. You can buy ETF's

which contain all the

stocks of the S&P 500, the Dogs of the Dow, only gold stocks,

stocks from Malaysia and a host of other sectors.

Some ETF's trade like water

and others....some days you might not find a buyer at the price you

would like to

unload them at. I would treat narrowly focused

ETF's as I would a sector fund or stock - no more than

4-5%.

Looking at the latest YTD

returns for the more popular ETF's, one thing which stands out is some

of my mutual fund

selections are out performing the best performing ETF's.

I think if you own an ETF

in whatever the hottest sectors at the moment are, you could do pretty

well. I traded in and

out of ADRE when oil and metals started moving up and did ok. I ended

up being more comfortable with PSPFX,

a global materials mutual fund, which I still own.

Whichever way you go, here are couple of my favorite do's and don'ts.

Do

Educate yourself. This is a great place to start: http://www.bobbrinker.com/books.asp

If you are uncomfortable managing things yourself, use the services of a fee only planner. Get references.

Spend some time listening

to Bob Brinker. You can record shows yourself or sign up for

PodCasts. It's amazing

how much you can pick up by osmosis.

Another option for help in

managing your accounts comes from the Mutual Fund Store. www.mutualfundstore.com.

If you have 50K in assets, they will manage your portfolios for

you. They charge a sliding scale from @ 3% down,

depending on how much they manage.

I've listened to Adam Bold,

founder of the Mutual Fund store for several years and I would use his

services if I didn't

like doing it so much myself. He also has another service called Smart

401K where for about $50.00 a quarter

(cheaper by the year), you can log in and input the fund choices you

have and a real person gets back to you

with a preferred list of suggestions.

They are active managers -

if a fund fails to perform, they dump it. Compare this to a

broker who sells you

something and that's the last you hear from him.

Be sure to consider Taxes on trades - a rarely mentioned item.

Dont

Do Not buy broker sold

funds unless you think giving the broker 5-6% (or more) or your money

to buy from their

house funds is a good idea. No load brokerages have hundreds

of funds to choose from.

Do Not get suckered into

buying an annuity. Especially despicable are those who try to

convince you that placing a

tax deferred account like your roll-over IRA in to a "Guaranteed

Income" annuity is a smart idea. It is not.

Fees and expenses will eat you alive.

Do Not buy stocks as a

result of Lunchroom Gossip or the latest message board hot topic and

expect to do very

well. Spend some time doing actual research.

Be wary of the 'Cramer Effect'.

There are actually some published papers on this. The short of it, is

stocks featured

on 'Cramer' frequently move up in after-hours trading. Buy first thing

the following morning and you pay a premium

price for the stock. The stock tends to drift back down after a couple

days. There are other papers out there whose

topic is 'Shorting Cramer', which attempts to take advantage of the

short term price spike.

Taxes - one item rarely mentioned is the taxes you get to pay on short term trades.

Someone once gave me some pretty good advice when it comes to stocks:

Buying a good quality stock once for the long term - you only have to be right once.

Buying stock short term - you have to be right twice (when to buy and when to sell).

Which has the better odds?

Well, enough of that. Time to go to press.