| April, 2013 "..... the suggestion in a government document that a reporter could be guilty of espionage for engaging in routine reporting is unprecedented and has alarmed many journalists and civil libertarians. " Did you vote for the teleprompter? Twice? Then congratulations because you *did* build that! " ~ Cromulent |

|

The Professional Opinion - DJ 15115.57 Bob sure would like to see a significant correction..  Buy Recommendations None. Everything is rated as a hold, as is usually the case. However, I might look at COS or BMO for a little international diversification.....  |

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. |

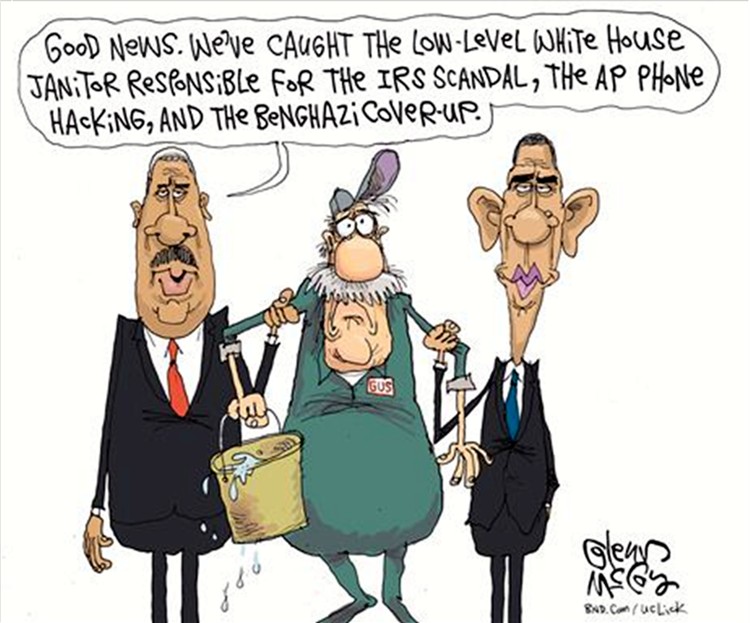

What is it the teleprompter said during its first term? Something like, 'We are going to have the most transparent administration in history!' Reality however, is that we are seeing one of the most corrupt administrations in modern history. I never watch CSPAN but decided to make the hearings on the IRS targeting of conservative groups an exception. What I saw and heard did not inspire confidence at all. I wonder if the press at large is going to finally be inspired to do some real reporting now that some of their own have been targeted as well....probably have to dream on, on that one. Meanwhile, the Fed keeps buying bonds and we who invest in equities are making a killing. These are strange but profitable times and with a market PE of only somewhere around 17, it could be profitable for quite some time.  |

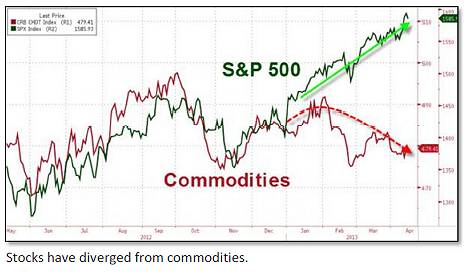

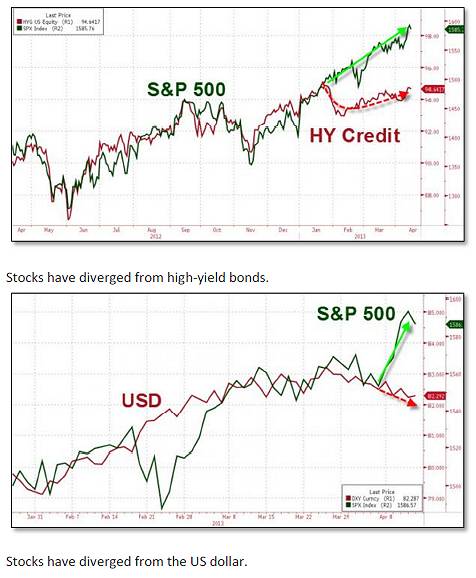

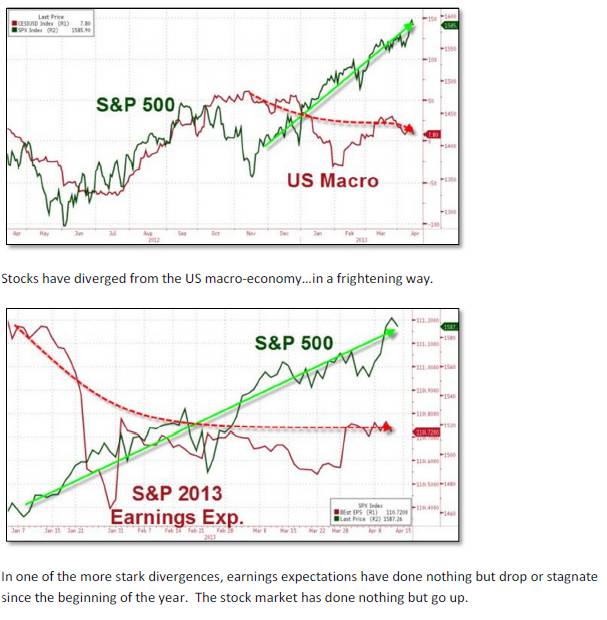

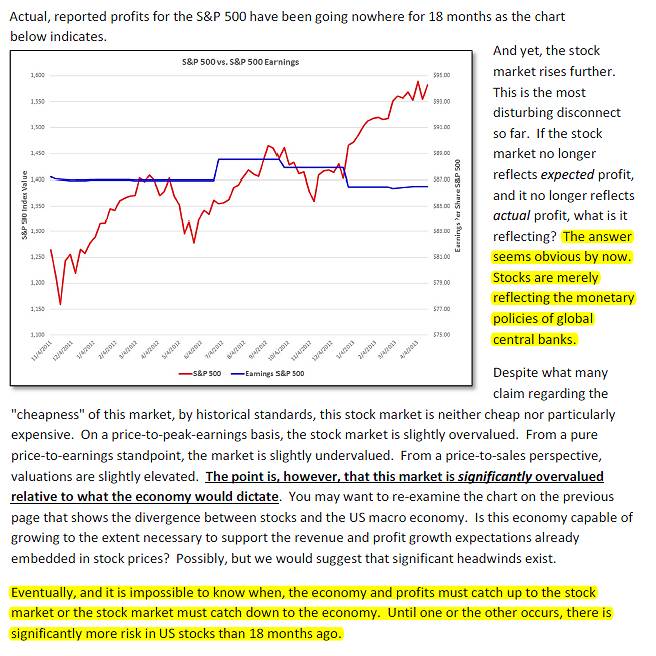

How about Blackstone.......  I sure hope others sat up and took notice of Blackstone and picked up a few shares. I think there is still room for growth here and I am currently over weight the stock. I did lighten up a little though, as it was becoming too large a percentage of the portfolio. Heck, at these prices Blackstone still sports a yield of around 4%. Staples - a Favorite Tradable Stock.......  Staples is now one of my favorite stocks for buying on the dips and selling on the highs and if I pay attention, I can even collect the dividend. This stock has worked very well for retirement accounts. You can add significant chunks of change to your portfolio with a little practice. Stocks Diverge from Reality or......Welcome to the Twilight Zone      The above are snippets from the latest Capitalist Pigs Newsletter and the entire newsletter is well worth reading. May Newsletter Personally, I have taken all the gains I've made for 2013 so far and put them in cash. The amount of those gains YTD has been surreal. I can't see how the economy as a whole justifies those gains so I might as well keep them. I was not real thrilled last time, when Bob Brinker was on the radio talking about the collapse of Lehman Brothers real-time, and he did no portfolio changes as the market cratered. I am all for making lots of money in this Twilight Zone economy, but I also know at some point this party is going to stop. It would be nice to have a crystal ball but absent that, a measured amount of prudence will have to suffice.  As an aside, the price on FGMNX is looking attractive again for those who don't really care for the rates offered by Treasuries and Money Markets. Time for some Canadian diversification COS - Canadian Oil Sands (COS, COSWF)   Canadian Oil Sands was my pick for diversification. They pay a healthy dividend and the stock is not as volatile may in the commodities sector. You won't find much about the company through the likes of Google or Yahoo. Going to the company web page is the best place for financial information. There is a considerable delay if you are thinking about making a market purchase. Putting in a bid and sell price would be the better bet. Some Further Information If I wanted to diversify into Canada a bit further, Bank of Montreal (BMO) would be an attractive purchase.  |