May 2007

Market Timing Update

"In the short

run, the market is a voting machine but in the long run it is a

weighing machine. "

-Warren Buffett

Market

Valuation

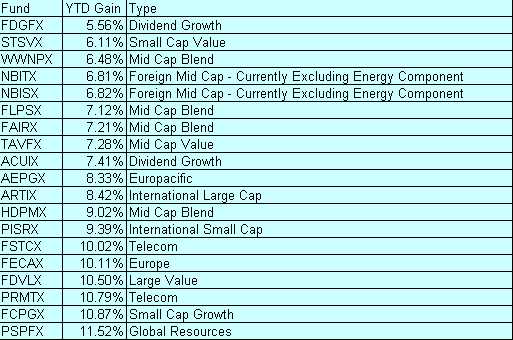

This month Bob looks at overall market valuation and he believes it is

reasonable because of the modest

rate of stock market appreciation and increasing corporate

earnings.

Year

Yearend

Reported P/E

Operating

Close Earnings Earnings

P/E

1987

247.09 $17.50

14.1 $19.91

12.4

1988 277.72

$23.75

11.7 $24.12 11.5

1989 353.40

$22.87

15.5 $24.32

14.5

1990 330.22

$21.34

15.5 $22.65

14.6

1991 417.09

$15.97

26.2 $19.30

21.6

1992 435.71

$19.09

22.8 $20.87

20.9

1993 466.45

$21.89

21.3 $26.90

17.3

1994 459.27

$30.60

15.0 $31.75

14.5

1995 615.93

$33.96

18.1 $37.70 16.3

1996 740.74

$38.73

19.1 $40.63

18.2

1997 970.43

$39.72

24.4 $44.01 22.1

1998

1229.23 $37.71

32.6 $44.27

27.8

1999

1469.25 $48.17

30.5 $51.68

28.4

2000

1320.28 $50.00

26.4 $56.13

23.5

2001

1148.08 $24.69

46.5 $38.85

29.6

2002 879.82

$27.59

31.9 $46.04

19.1

2003 1111.92

$48.74

22.8 $54.69

20.3

2004 1211.92

$58.55

20.7 $67.68

17.9

2005 1248.29

$69.93

17.9 $76.45

16.3

2006 1418.30

$81.51

17.4 $87.72

16.2

2007 1482.37

$87.00

17.0 $92.00

16.1 *

* closing price on April 30, 2007.

He is comfortable with a Forward PE

ratio going forward of 16 - 17 as an estimate.

Low core inflation is expected to remain low.

The economy will continue to grow at a rate below trend and Bernake

will probably be called on the carpet because

of it. It seems only the Fed sees inflation gremlins

lurking in every corner.

Consumers are continuing to spend at a moderate pace and they are

learning to deal with higher gas prices.

The 60 day Put-Call ratio, a contrary indicator remains very

high. Lots of bearish sentiment.

New investors are encouraged to buy on weakness and dollar

cost average their way into the market.

Bob believes the S&P 500 index is getting ready to break the

previous record high of 1527.46 and if

it does, there will be new recovery highs.

Fed Policy

The fed funds rate of 5.25% will remain unchanged,

given below-trend economic growth of the economy of

2-2.8%. The long term range is typically 3-3.5%

No changes to Fed policy.

Market Timer Portfolios

No changes to Portfolios

Personal Portfolio

Level 3 Communications (LVLT)

Once again Level 3 fails to disappoint. I sold the position

and bought back into DR Horton (DHI) in the

high 22's. Looked like a pretty good buy-in

point. Last time I sold @ 30 so perhaps this one

will run

again as housing starts to improve. There is a nice, healthy

dividend to look forward to in the interim.

Owens Corning (OC)

Boy, there were lots of people sweating over Owens Corning's first

quarter earnings release.

Lots of selling going on prior to the announcement:

05/02/07

NEW YORK (MarketWatch) -- Owens Corning (OC) Wednesday reported

first-quarter earnings of

$1 million, or a penny per share.

In the same period a year earlier,

the company's predecessor operations prior to its emergence

from bankruptcy protection, the company earned $63 million, or $1.05 a

share.

The company said its adjusted

earnings, excluding items, were $61 million, or 14 cents a share,

for the latest quarter.

Sales fell 17% in the three-month

period to $1.32 billion from $1.6 billion in the same period

a year earlier.

The average estimate of analysts

polled by Thomson Financial was for a profit of 20 cents a

share in the March period.

The Toledo, Ohio-based building

materials company said it expects its insulating systems business

to continue to be impacted by the slowdown in U.S. housing starts

that's expected to extend well

into 2007 by the National Association of Home Builders.

It backed a projection that earnings

before interest and taxes, or EBIT, should exceed $415

million in 2007, excluding the impact of its proposed joint venture

with Vetrotex or other strategic

organizational changes.

The stock closed Tuesday at

$31.78, up 3.7%.

A recording of

the conference call is availible for playback or download here:

My opinion: Long Term

Hold. Buy on weakness. I'd say a range of 28-32 is

an attractive buy range.

This

Stuff Just Continues to Amaze

Masco, one of my DRIP's also reported earnings:

Masco

Corp. (MAS 30.15 +2.94) reported a 30%

drop in quarterly net income,

as a decline in new home construction and a moderation in consumer

spending

crimped demand for its home improvement products.

However, the results surpassed analysts'

expectations, and shares of the Taylor,

Mich.-based company gained as much as 16%

during the regular trading session.

That huge spike is after

reported earnings.

The thing is they did badly, but not as badly as everyone expected.

Kind of goes to show - if you believe the company is a quality holding,

don't sweat the short term stuff.

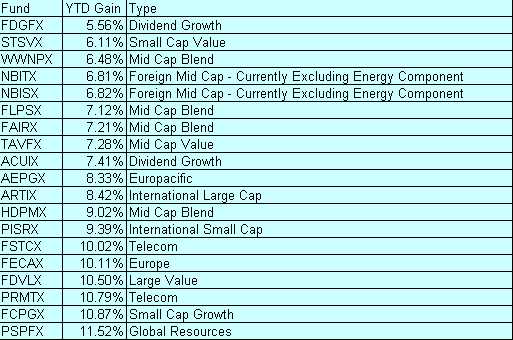

Fund YTD Performance

This is kind of interesting in

that performance by fund type is all over the map.

I was surprised Fidelity Dividend Growth is lagging as much as

it is so I am moving about half

of FDGFX into Fidelity Value (FDVLX). That should

pan out a little better.

I think I will also take PSPFX from 3.2% to 5% by

trading out some of the Fairholme fund.

Global Resources as a sector for about 5% is probably a good place to

be.

Just look at gas and other commodity prices.

I originally thought PSPFX would be a short term play but anymore it

seems like a good sector holding.

Monthly Rant, Sermon or Whatever........

None this month. If there is a topic you are interested in

and it happens to be something I know something

about, let me know.