| March, 2013 "The trick is to stop thinking of it as 'your' money." ~ IRS Auditor |

|

The Professional Opinion - DJ 14578.54 Bob likes the numbers he is seeing.  Buy Recommendations None. Everything is rated as a hold, as is usually the case. However, I would personally be looking at Suncor (SU) in the very low 30's if one were so inclined for a shorter term trade.  Coyote - Genoa, NV |

Note: Gains or losses shown here with the exception of mutual funds are from the original purchase date, not yearly returns. Blackstone and Leucadia sure are performing nicely! Apple however.......... I picked up a few more shares in the low 4's. |  What a government, aye? Lurching from crisis to crisis, threats of gloom and doom and apocalypse lest the government spends less money....God forbid. Following the Clinton method of sticking a finger up in the air to see which way the wind's blowing and then following through, would be a far more effective form of leadership than what we have now. The markets are performing well enough in spite of all of this and that is a good thing. The FED's easy money policy sure is helping out anyone owning equities! Let's keep this up for just a little while longer.  |

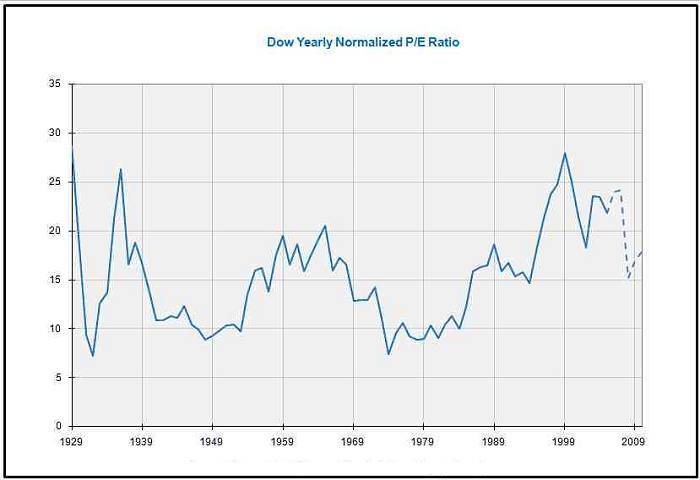

Bottom Fishing or.....Speculation Wednesday (03-13)    One of my favorite pastimes during the lunch hour is going bottom fishing and with the current state of the markets, that's getting harder to do. Spectrum reported earnings not to the market's liking and the stock fell to the lowest it has been in a year. I don't know a lot about biotech so I stay generally stay away from it. However, this was just too tempting. These violent reactions to earnings misses can be a buying opportunity so I took the opportunity to to some buying. I suspect this will be a relatively short term hold. This is nothing worth betting the farm on and one cardinal rule with this type of event is that the stock can always go lower. It's no fun trying to catch a falling knife. Let's check back in a couple weeks and see how this panned out.....   Synovus has been on my list of bottom fishing possibilities for a long time. This bank had a ton of bad debt and had to take TARP funds in order to stay afloat. The stock hasn't moved for a long time but lately has begun to show signs of life. Rumor has it that it will pay off the TARP funds this year, sooner rather than later and that in itself will significantly improve the bottom line. It seems to be doing the right things and the real estate markets are improving. The bank is late to the party when it comes to returning to profitability but if you are looking for something that may still be significantly under-valued, this would be worth looking at. Snippet from other commentary:  Putting this into some perspective, I have seen a number of stocks fall dramatically to two dollars and change during the Dot-Com bust in the early 2000's and then again in 2008, later returning to values of over $20.00 a share. Another thing to consider is that most mutual funds cannot buy positions in stocks valued under $5.00 a share (penny stocks). If SNV manages to go back over $5.00 and stay there, institutional investors might step in and add support to higher valuations. PE Multiples - When to get Concerned PE or Price to Earnings Ratio is the price of a stock divided by the earnings per share. That is to say that if Stock XYZ is selling at $10.00 a share and its earnings are $1.00 per share, if would have a PE of 10. The higher the PE of a stock, the more gambling is priced in that the shares will move higher and the company will do better. An example of a stock with a very high PE might be a Biotech Stock, where the price is being bid up in hopes their latest cure for cancer will make it past the FDA, and thus turn their penny stock into a small fortune. A low PE usually means that a company is fairly priced and not likely go great guns in the future. It might be a utility which pays a modest dividend or it might be a company which has no plans for growth or expansion - it is happy exactly where it is at.  One of the things that those who time the markets look at is the PE of major indexes, in hopes of determining whether or not a market is too richly valued and thus due for a major correction. So, what is too high? 33.75 for the Russell 2000? or 18.15 for the S&P 500? Or how about 15.94 for the Dow Industrials?  Not being a chartist myself but having been through a few cycles, I would say when the S&P PE hovers around 20, I might start being a bit more vigilant. A PE of 25 would probably inspire me to start increasing my cash position.  ......I can see how charts and astrology could make comfortable bedmates.... Personally, I am starting to read and here more and more about how the great tide is beginning to turn out of bonds and into the stock market. There has to be some truth to that because the returns in the bond market have been pathetic and those living on fixed income are going to increasingly have a tougher time of it as they search for yield as their current holding mature. The time to be really concerned is when everyone is all-in, in search of a better return. In 2000 during the DotCom boom, money was literally thrown into the market because like the housing bubble, prices can only go higher....right? Here is a snippet from Alan Greenspan:  I do think we still have a ways to go and I hope to make hay while the sun shines. Privacy? What Privacy?  Gotta love social media - not. So what's up with the Gloom and Doom Crowd these Days? Lets start with Peter Schiff, of Europacific Capital:  Boy, this sounds pretty bad. Should I worry? What does Robert Weidemer, economist and author has to say:  ....a best selling author too. Then of course there's Harry Dent, of whom the great and powerful OZ.....whoops - I mean Suze, is a follower:  This guy is also an author, believe it or not. I mean, authors never predict cataclysm to sell more books...do they? There has to be something more solid. Something with a foundation in science and mathematics. Well..........this is kind of close:  I think Mr Crawford should be brought to the attention of 'Coast to Coast.' He would make if not an inspirational guest, a very entertaining one. Here is a Sample Newsletter Couldn't resist. Here's a bit more from a 2012 issue:   And last but not least, how about something from a quantitative researcher:  A global stock market crash every two years? Time to build that bunker, stock that food, buy a wind-up radio and bar the door. Facebook Privacy Data Mining?.... Naaahhhh....Tell me it's not true!  All the more reason to lie your @$$ off if you feel you must use one of these sites.  Red Tailed Hawk (Dark Morph) - Presumably. Gardnerville, NV |