The Professional Opinion - DJ 16321.71

Buy Recommendations

None

Sell Recommendations

None

Note: Definition of FIRP - Federal Interest Rate Policy

UFC Rematch - Chris Weidman vs Anderson Silva. I don't think legs are meant to bend that way.

| February - March, 2014 "I guess the question I'm asked the most often is: 'When you were sitting in that capsule listening to the count-down, how did you feel?' Well, the answer to that one is easy. I felt exactly how you would feel if you were getting ready to launch and knew you were sitting on top of two million parts -- all built by the lowest bidder on a government contract." ~ John Glenn during his retirement speech. |

|

The Professional Opinion - DJ 16321.71  Buy Recommendations None Sell Recommendations None Note: Definition of FIRP - Federal Interest Rate Policy UFC Rematch - Chris Weidman vs Anderson Silva. I don't think legs are meant to bend that way. |

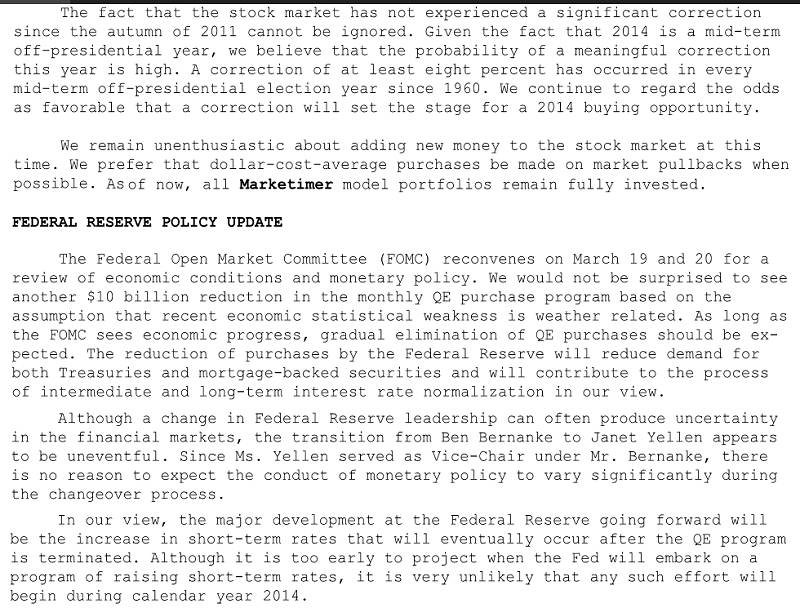

Well it looks like Western Lithium won the month, hands down! |

This month, the Wall of Worry focused around the emerging markets and its hard to tell how concerning the problems are because Argentina has been lying, China is more than likely lying.........who else is lying? It's looking to me like it's still worth being overweight in Blackstone (BX) and other private equity / business development companies for the near term. I'm still staying away from commodities with the exception of WPZ, which has a nice dividend. Should be an interesting year!  |

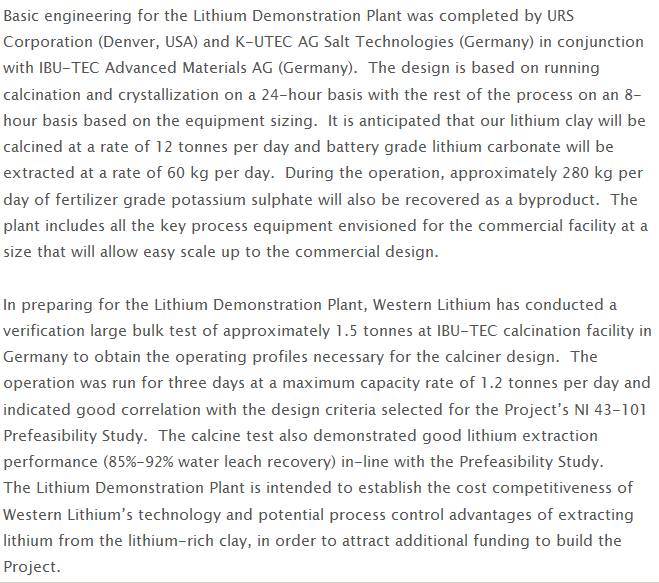

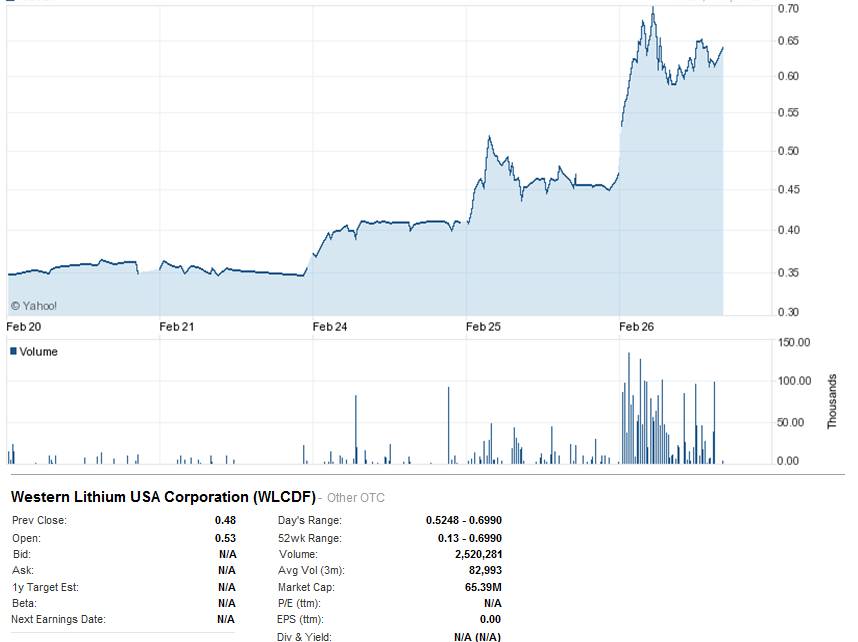

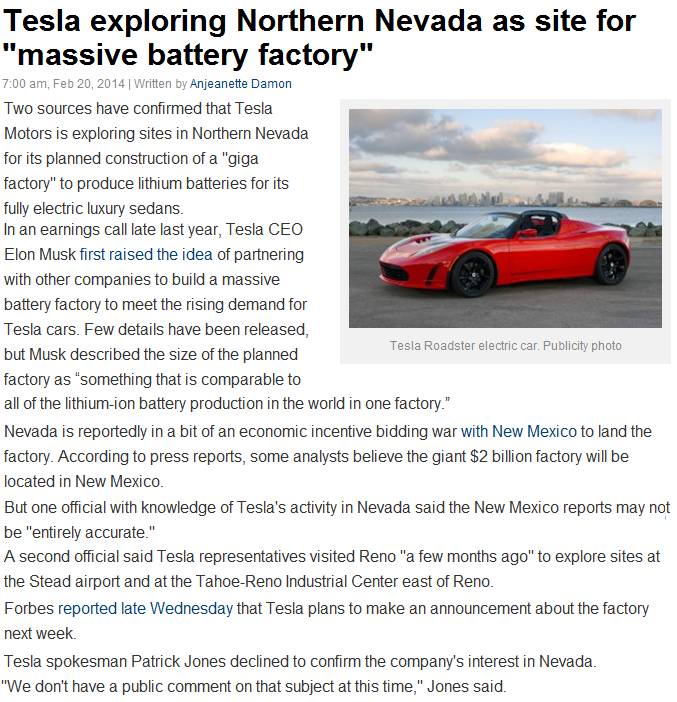

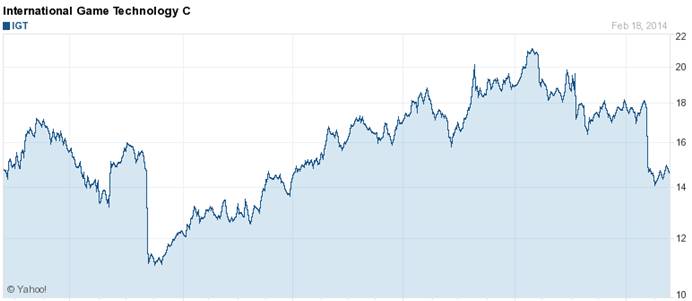

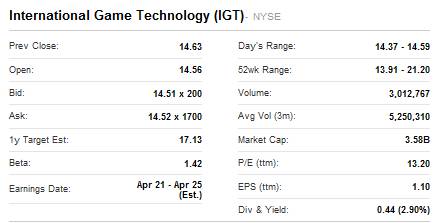

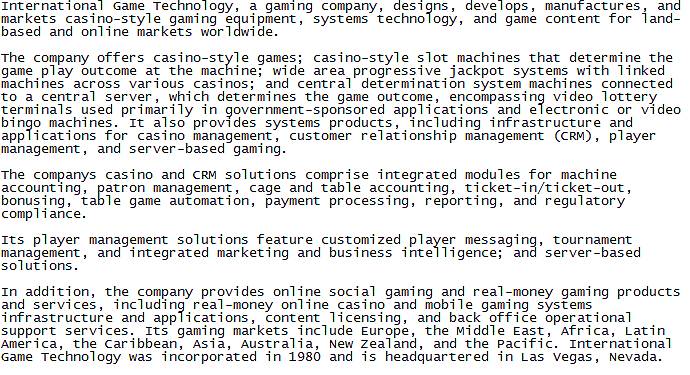

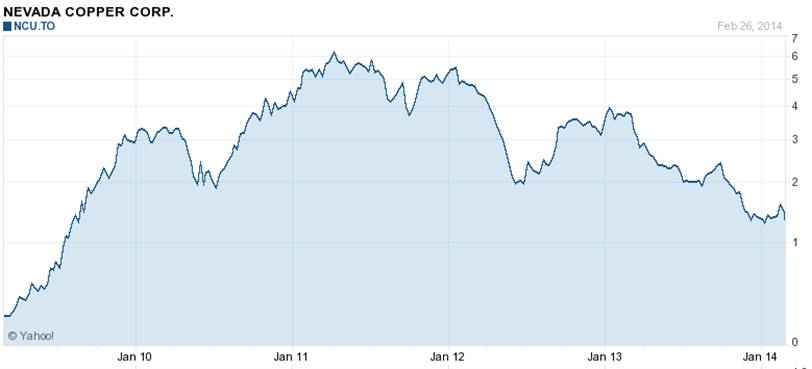

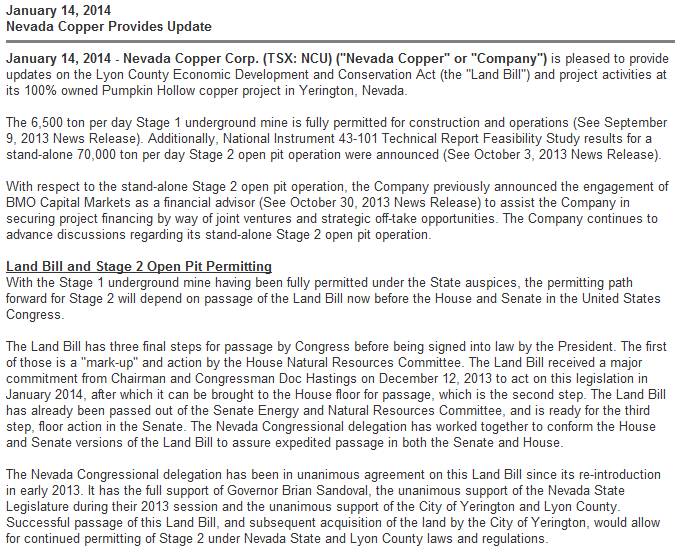

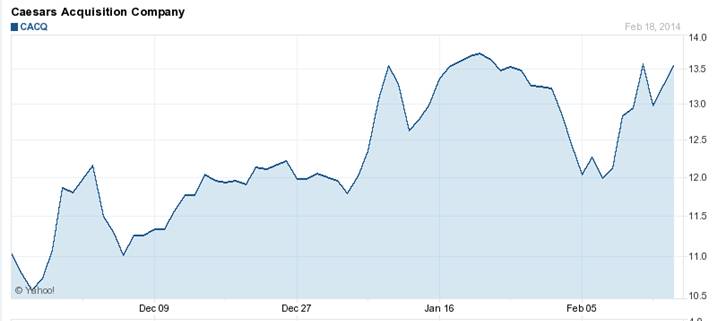

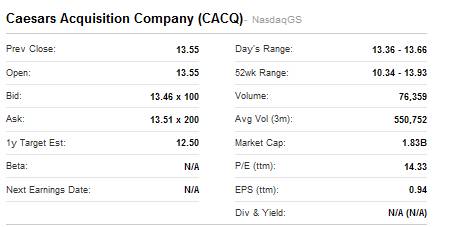

| Nevada Day - a Focus on Local Stocks Western Lithium - An Update on My Favorite Penny Stock  Concrete foundation construction for process equipment, February 2014   Western Lithium (WLCDF) was good to me in 2013, made three extra house payments and boosted the Roth IRA's. I'm thinking it might be time to get back in again, somewhere around .32 cents. I don't see it going much lower than that because apparently, progress is being made! I drove out to Fernley last year and had a look for myself. I still regard this as pure speculation on a company that has yet to produce anything, but I do think the odds are tilting towards a viable company. Again, this is pure speculation and I don't think the company has yet to get its final BLM permitting in place. This isn't anything worth betting the farm on but if I can make a few more house payments on a nice run-up, deserved or not......then I'm ok with that. Strange times we're living in when it makes more sense to accelerate the payments on the hose and let the car payments ride..... 02/27/2014 Update   Gee, who would ever have expected a bizarre run-up would happen again....and what could have caused it this time?  This explains a few things and I finally got a partial fill at .35. Three days later I sold out at .55, but had a sell order in for .48. The stock opened much higher than I thought it would and since I had a limit set, the trade executed at the higher opening price. It looks like I could have held out a few hours longer, doesn't it. But.........I'm happy with a 50% gain. That'll make a couple more house payments. I fully expect the stock will drop again back to at least the .30's and at that point I may be a buyer again. It helps to have settled cash for these kinds of trades so you don't fall afoul of the T+3 trading rule. Again, this is pure speculation. If you want to put money into something like this, you need to be prepared to take that same amount and throw those dollar bills in the air and take a flame thrower to them. If it works out, it can really work out! IGT - A Long Term Hold, Recently Departed    I thought it was finally time to cash in on IGT and pay the taxes, considering how shaky the economy seemed to be and that was a good plan. However, it turned out that the US economy wasn't the problem - it was the perceived slowdown in China that started tanking the stock and since the Chicoms lie all the time, it is hard to get a good read on how things really are. Buying back into IGT will probably happen at a later date. Until then, Western Lithium looks like a good stock to gamble away some of the proceeds. Nevada Copper (NCU) a TSE Traded Company  Anyone remember Nevada Copper and its Pumpkin Hollow mine out south of Fernley and over by Yerington. I've driven by it and it has been closed for years.    Well, it appears the mine is re-opening and under new management, sporting Canadian ownership. I'm not sure what to think of this. I've driven by the tailings for years. Apparently there is financing in place for long-lead equipment and for financing day-to-day activities in the interim.....sound familiar? I think this one bears more looking into. Mining has made something or a resurgence in the past few years and things were going great guns until the price dropped out of the gold market. I know Red Hawk is providing financing. Red Hawk invests in mining operations and they are nobody's fool. And....the price is certainly cheap enough. CACQ - The New Kid on the Block - How's it Faring?    I rarely buy new issues in any meaningful quantity, but in this one I made an exception at 2.5% of the portfolio. The way I see it, most states are hard-up for revenue and are looking for ways to expand their tax base, and the teleprompter sure isn't lending a hand, and neither is the dysfunctional congress. If raising taxes isn't working because people are working less willingly or not (usually not), what is one way to raise more revenue? Gambling - works every time and CACQ looks to me like a good vehicle for getting a piece of that. Some big names in the gambling industry have come out against on line gaming, and just as many have come out for it. I suspect the pro-gambling crowd will win the day. Small caps are volatile and this one is no exception, which makes it useful for swing trading. You pretty much have to have solid price targets when dealing with a company like this. |