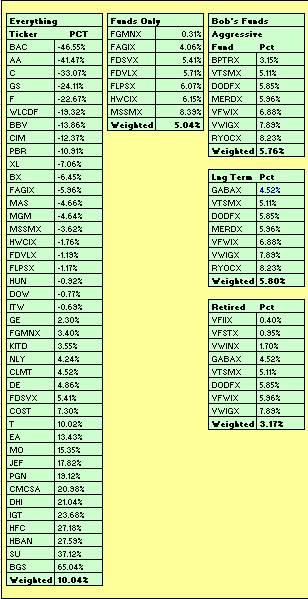

Personal

Portfolio

|

January certainly was a

reversal of fortune for most portfolios. One thing rather

disconcerting is average NYSE trading volume for the month was 20% less

than January of 2011. Thin volume leads to more volatility.

Meanwhile, the teleprompter blathered on again about doing what it

takes to create jobs - unless of course it involves the Keystone

pipeline or any other fossil fuel. What an

embarrassment to the country.

|

|

Personal Portfolio

Huntsman

remains one of my favorite stocks. Fenced 3/4 of an acre with the

proceeds from this one. I sold all my shares during the run-up

last year and have been slowly buying during the latter dips. At

these prices it still has an attractive dividend when compared to

treasuries.

Will it return to its prior highs? Maybe...but I think it would be prudent to take some profits along the way.

Annaly came out with their 4th quarter commentary, and it did not sound

rosy. 4th Quarter Commentary

Jefferies continues to improve and its detractors continue to eat crow.

HollyFrontier still looks like a bargain to me,

I picked up a little Calumet for the dividend, and I wanted

one more refiner, and one whose market differed from HFC.

My speculative investment is KIT Digital, which provides cloud-based

services as well as a host of others. In the 4th quarter of

2011, it appeared to have finally turned the corner and

delivered surprising results. I've already taken the profits out of

this once and am hanging on to the balance.

Late Entry: Amazon

Amazon

guided lower and the shares fell off sharply. Frankly, I think

this is a buying opportunity and picked up enough to fill up 2.75% of

the portfolio.

There were a number of written opinions all concerned with Amazon's spending too much money to build out and expand.

Really?

I thought the idea was to expand by building out in order to gain market share.

I got my shares in the $177 range and I think that at these levels, Amazon remains a bargain.

| NEW MONTHLY FEATURE: THE PROPHET WATCH

What we have here is CNBC's prophet, seer, revelator - and major PITA. Detailed Opinion Here

Financial Analyst - NOT

Soothsayer - NOT

Bearer of Practical Financial Opinion - Occasional

Man's Worst Nightmare - Maybe......

Having to listen to annuity pitches interspersed with vitamin infomercials could be worse.

Let's keep track of just how well this PITA's 'predictions' pan out for the rest of the year. |

| 2012 |

Predicted |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

| Gold |

$2,000.00 |

1736.7 |

|

|

|

|

|

|

|

|

|

|

|

| Recession |

60%

Chance |

Nope! |

|

|

|

|

|

|

|

|

|

|

|

| TIPS

Current 5yr Yield |

Home

Run - Maybe |

-0.95% |

|

|

|

|

|

|

|

|

|

|

|

Washoe fire - January, 2012. Allegedly

started by improper ash disposal.

|

|

|